Share

Dividing up aninheritancecan lead to a lot of tension, drama, and resentment.

In some cases, there are no easy answers.

Youre forced to make tough choices about who (not) to give money to.

The internet reacted really strongly to the post.

Losing a loved one is one of the worst things that can happen.

You might also want to hire a financial planner

Take things slowly.

You dont have to rush anywhere.

So, the joy of a financial boon is mixed with the grief of losing a loved one.

You still need to come to terms with the loss.

That should be your priority.

While we never truly get over losing a loved one, we can learn to live with their absence.

You should prioritize high-interest debt first, e.g.

if youve gone overboard with using credit cards before.

Next, youll want toinvestthe rest of the money.

Talk to some experts.

Consider your tolerance for risk.

Nobody can make the decision for you.

you might and should splurge a little bit.

Just try not to go overboard.

Its better to think about the far-off future, not just about short-term pleasure.

You potentially have enough money to turn your inheritance into generational wealth.

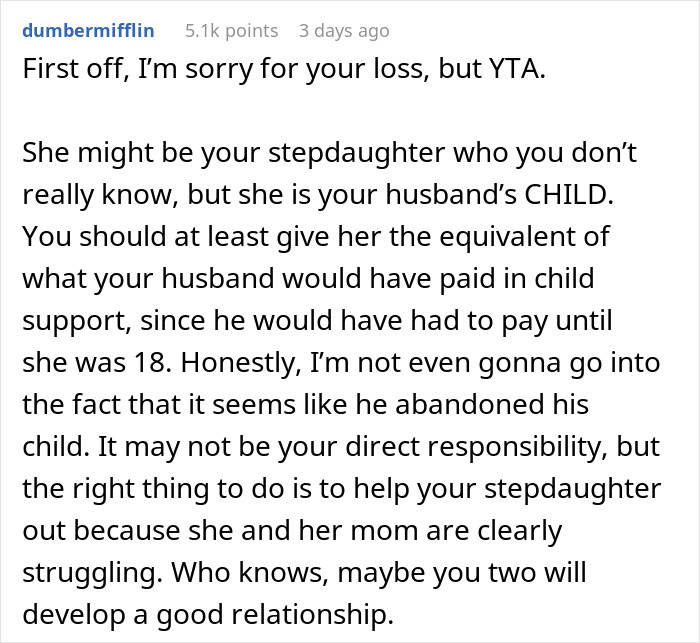

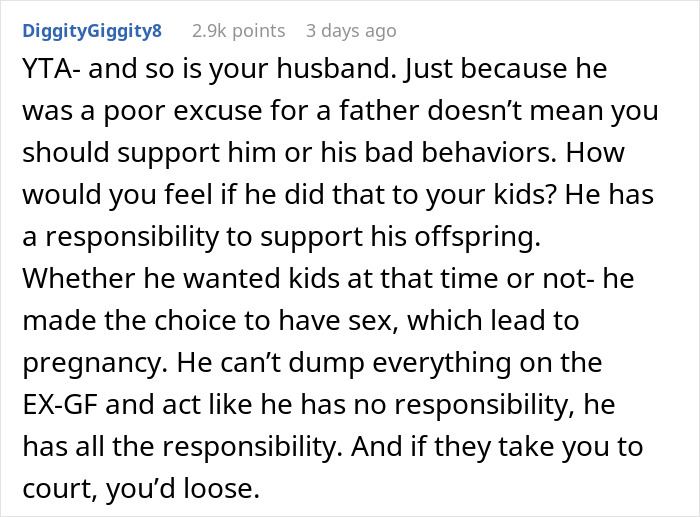

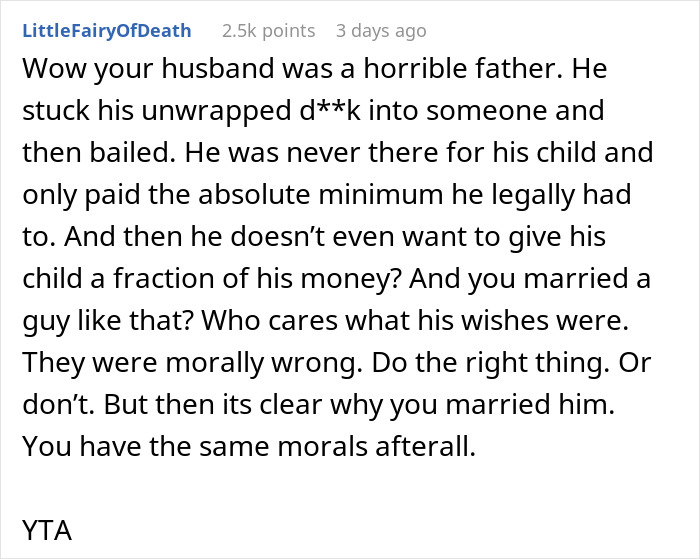

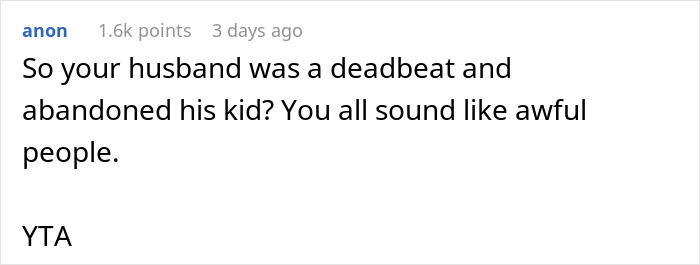

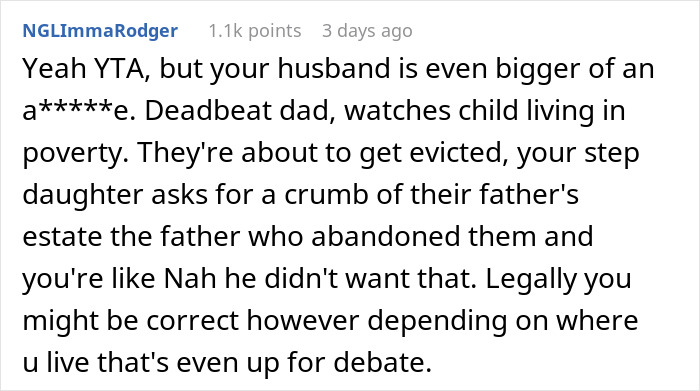

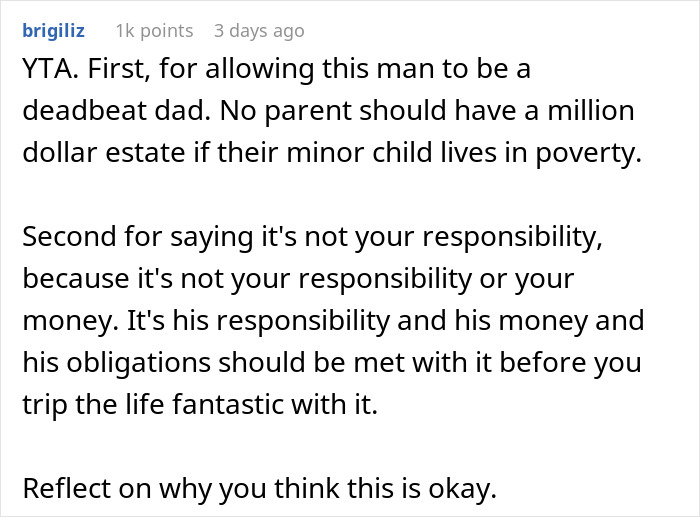

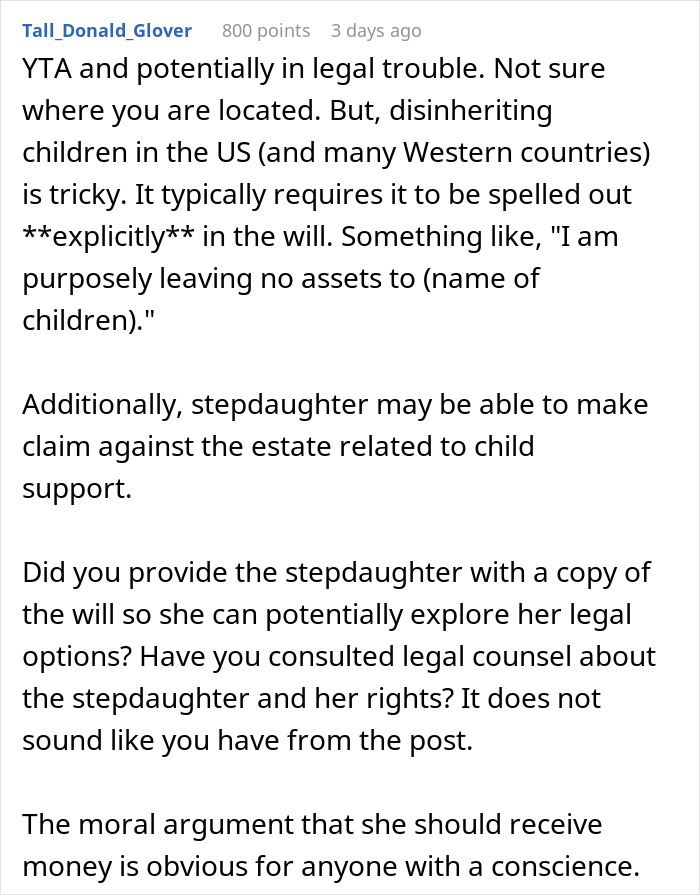

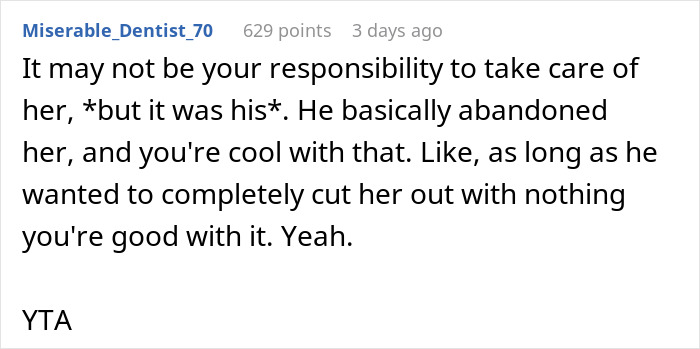

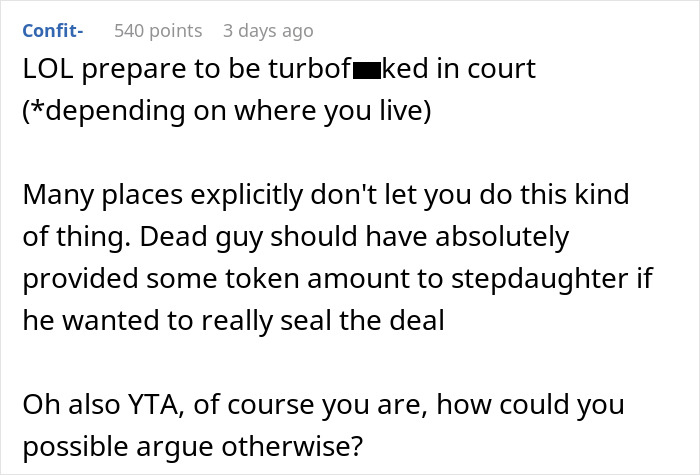

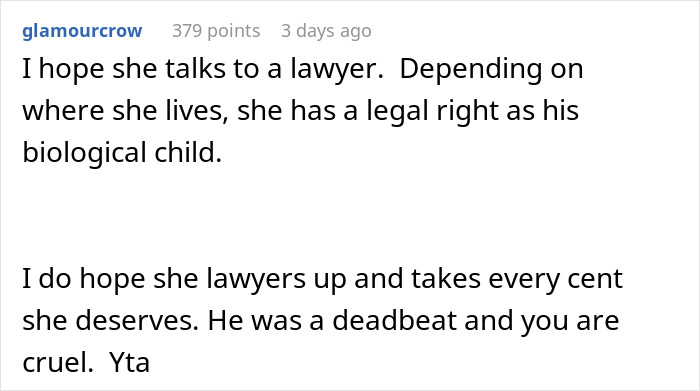

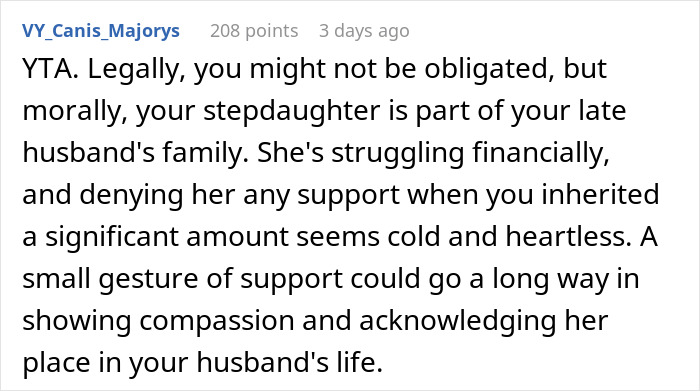

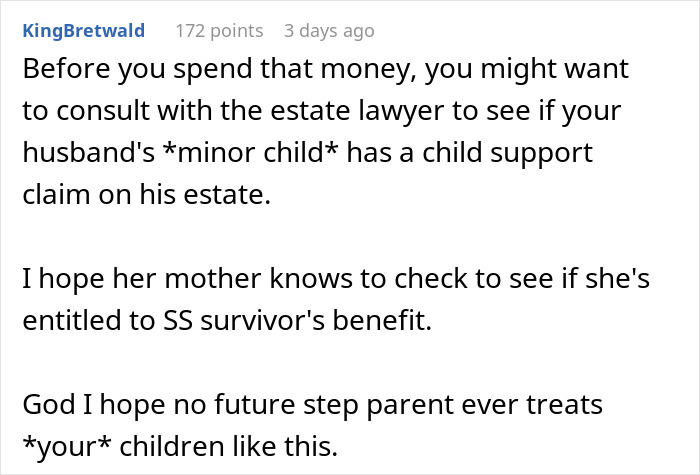

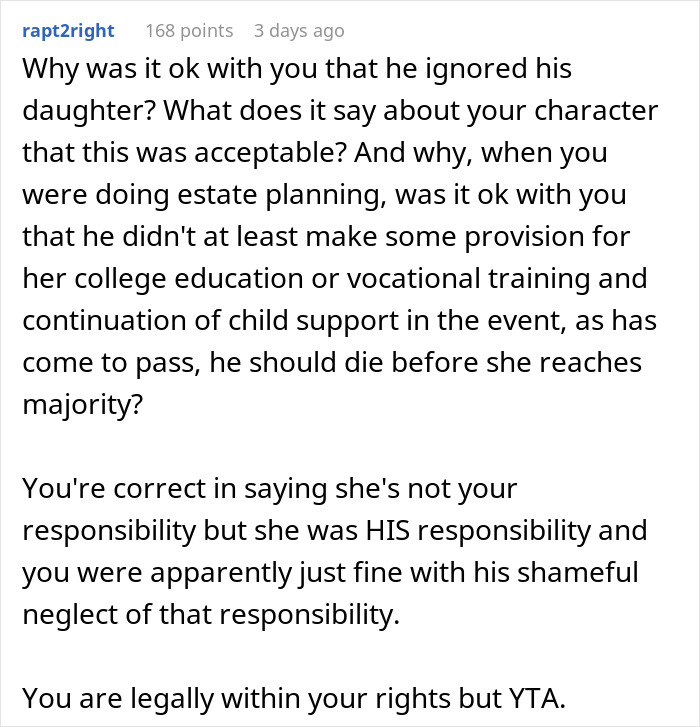

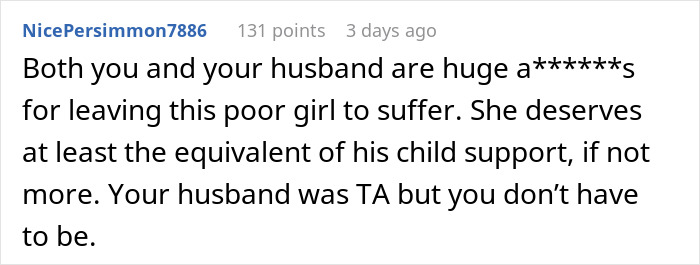

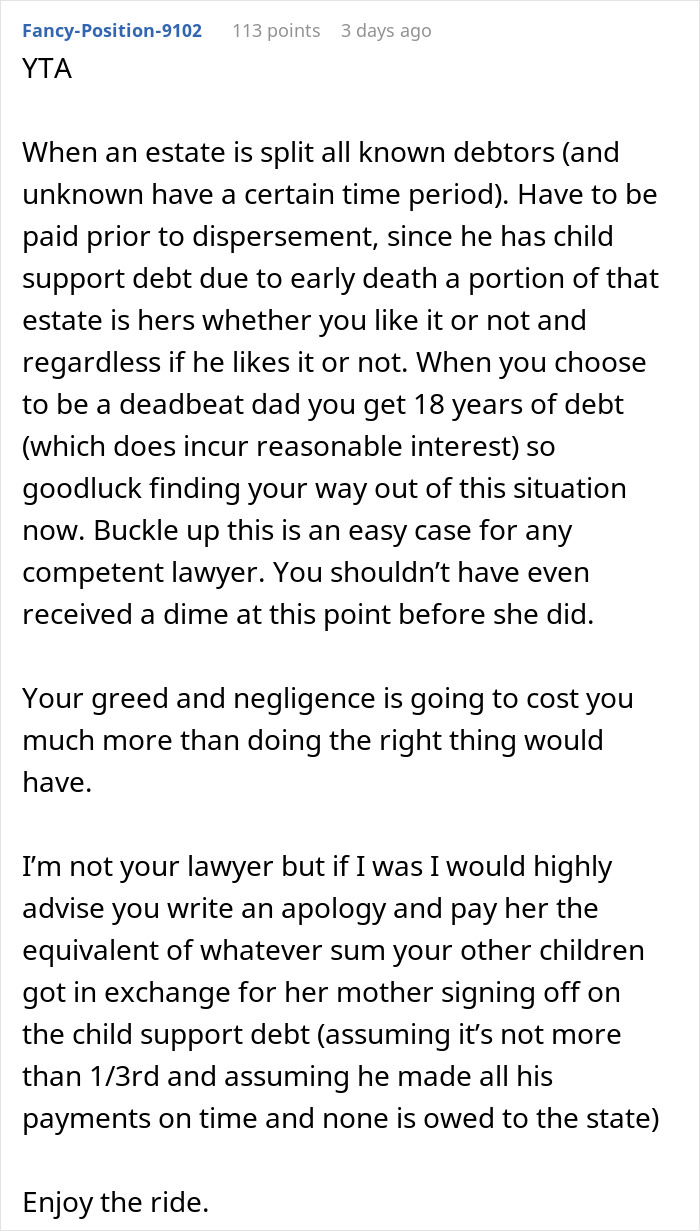

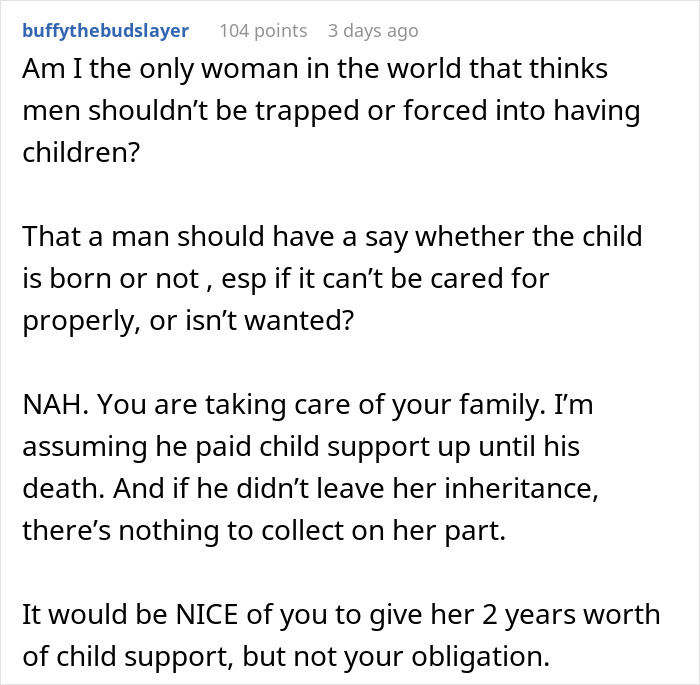

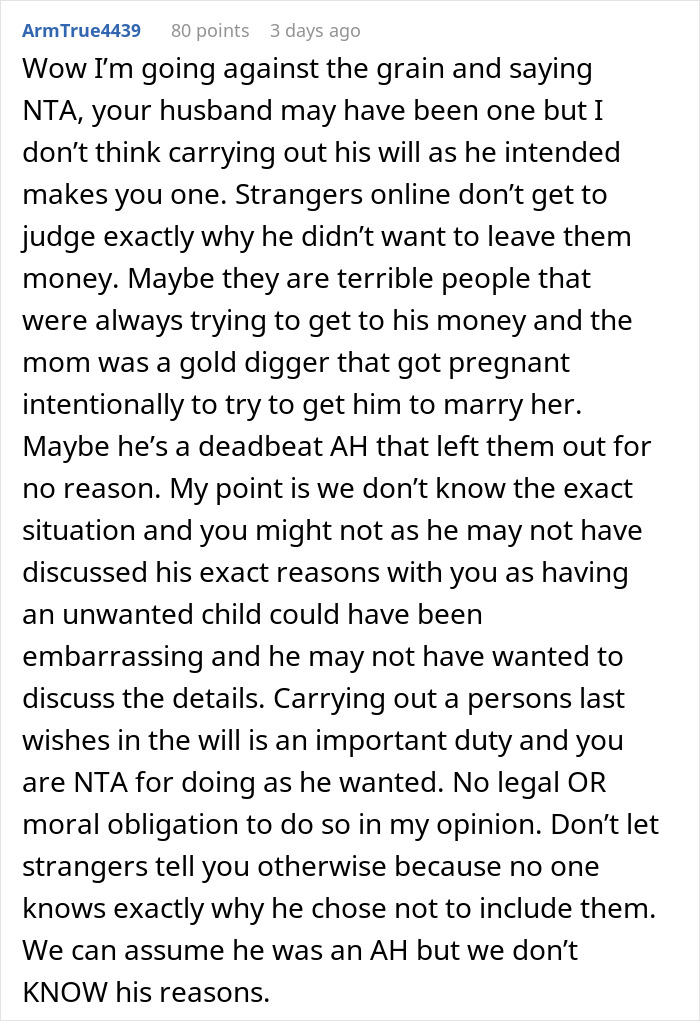

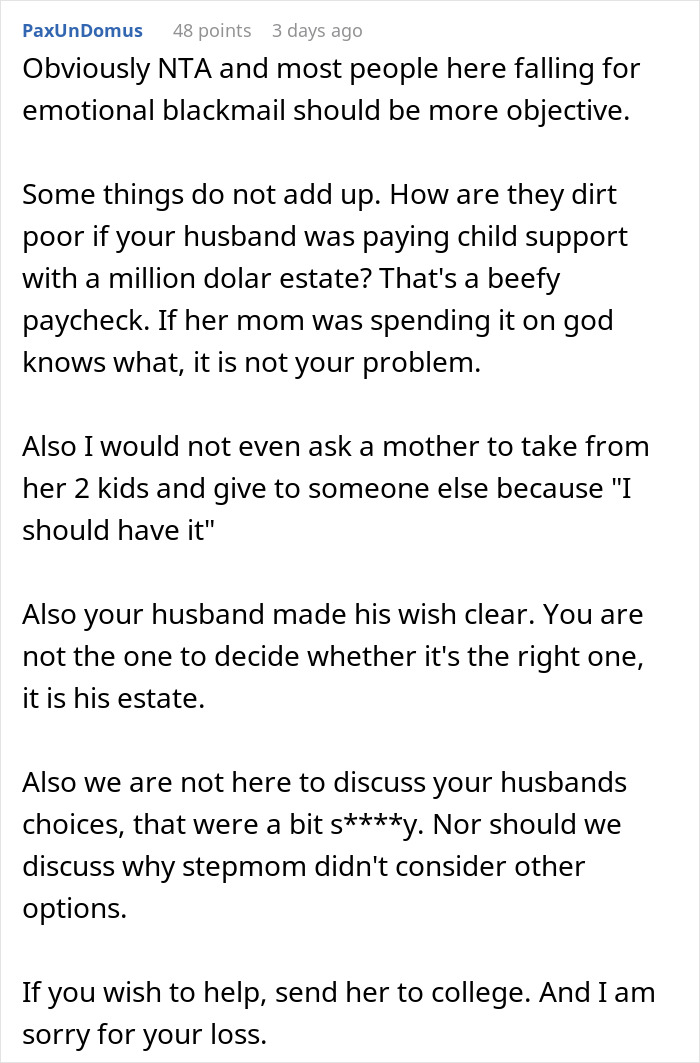

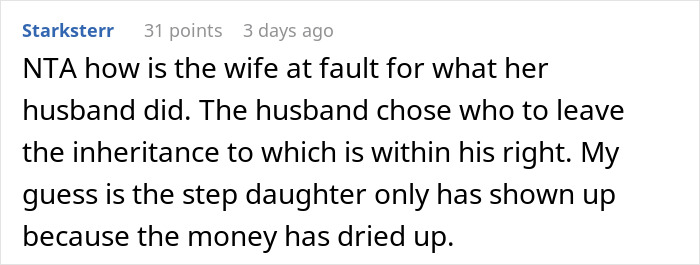

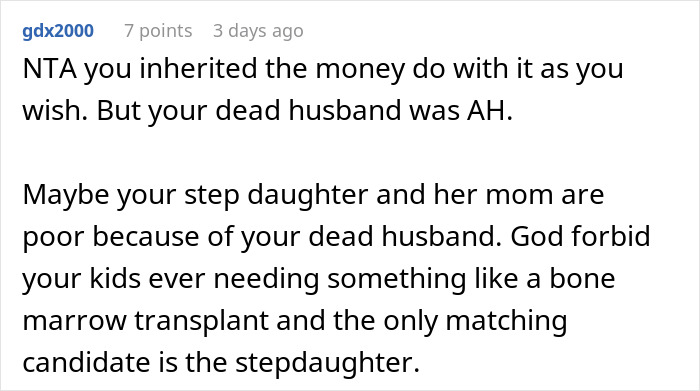

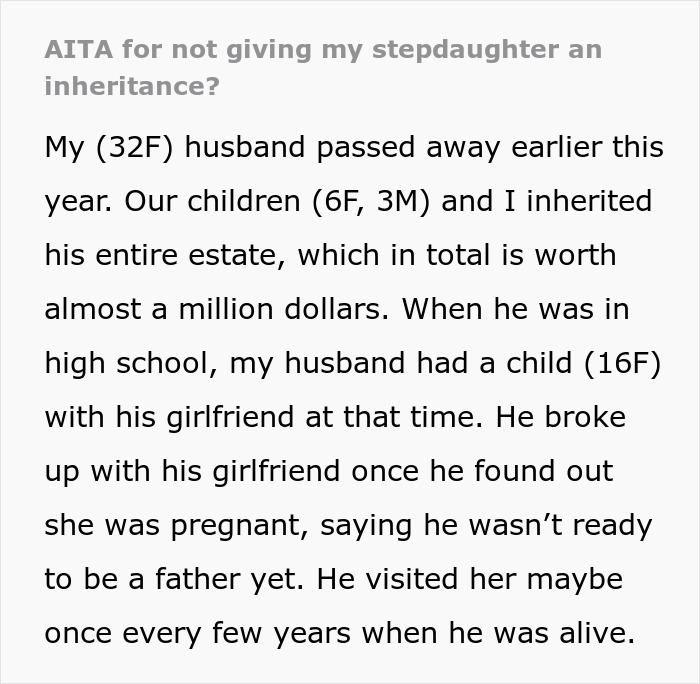

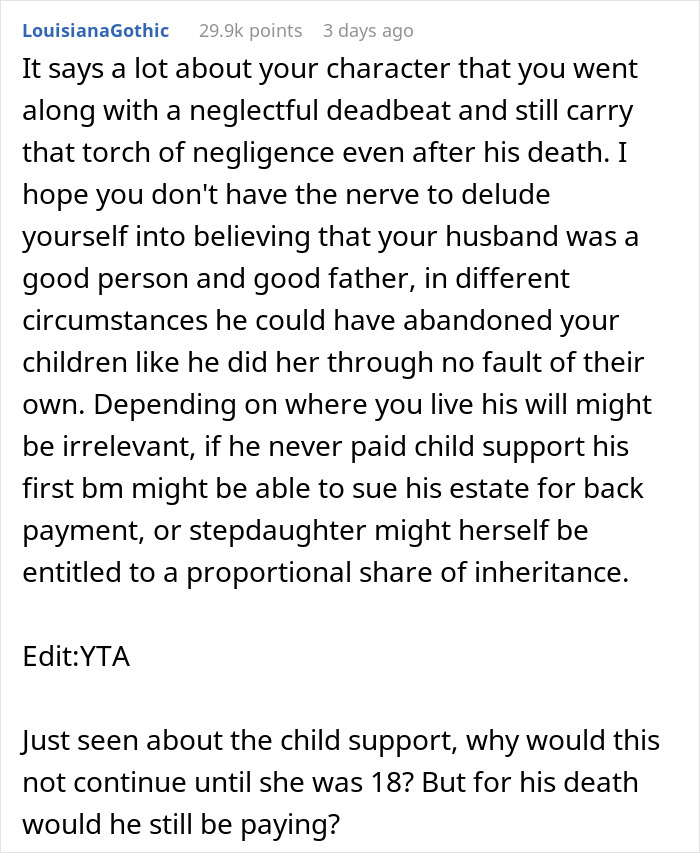

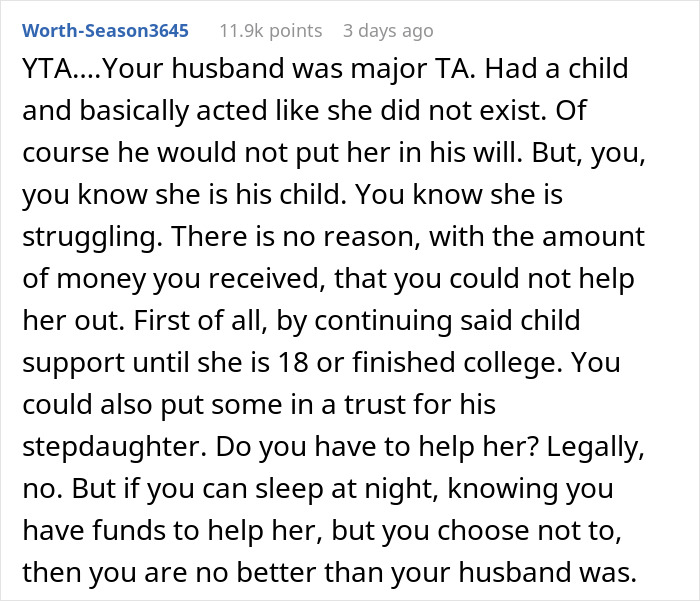

The sprawling AITA online community had an overwhelmingly negative reaction to the authors story.

They were shocked by her decision not to support her husbands child from another relationship.

From their perspective, she knows that his teenage daughter is struggling financially.

Nobody is entitled to anything.

How charitable someone is or isnt, is up to them.

Meanwhile, everyone else is free to judge these decisions as they wish.

And if you dont help them out, you risk angering them.

Where that line will be depends on what you value as an individual.

Even their distant family whom they dont even know all that well.

Distinguishing between the two can be hard at times.

Many readers were very critical of the authors decision.

Check out the results: