Share

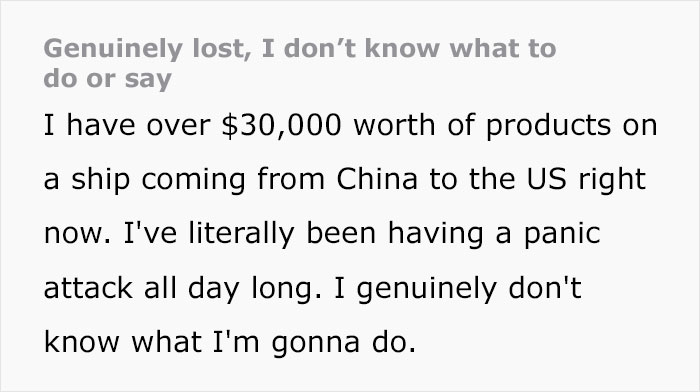

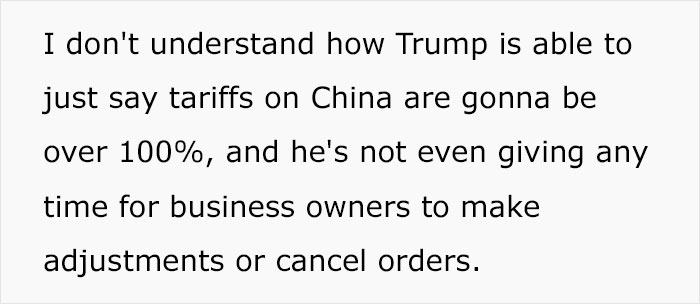

The last few months have forced many folks to engage in an unwanted crash course on basiceconomics.

Think of it like an extra fee you have to pay when you buy something from abroad.

Heres how it works: Imagine you want to buy a pair of shoes made in another country.

Without a tariff, the shoes might be sold at a certain price.

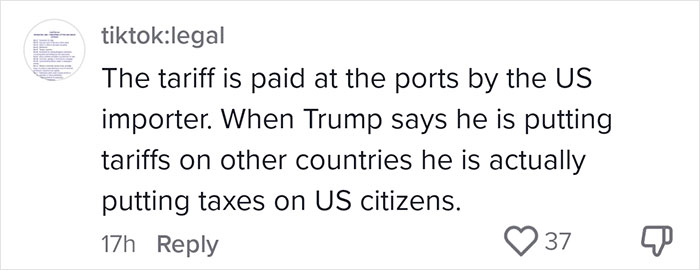

However, when the government adds a tariff, the importer has to pay extra on those shoes.

To cover that cost, the importer raises the price when selling the shoes in your country.

Governments may impose tariffs for a couple of reasons.

One is to protect local jobs and industries.

By making imported items more expensive, local products become more attractive to consumers because theyre cheaper in comparison.

Another reason is to generate revenue for the government.

Despite the claims of the administration, this is not a way to getfree money.

Moreover, high tariffs can force companies to reconfigure their supply chains.

One example is the idea of making the iPhone in the US.

Even by quite generousestimates, this would at least $290 to the price tag, if not more.

In the long run, it also hurts ones ability to sell your products abroad.

On a broader scale, these high tariffs may trigger trade disputes orretaliatory measuresfrom other countries.

Tariffs are a two way street, most nations wont just take them lying down.

Some argue that they might bring back manufacturing.

However, its important to point out that US manufacturing was growing!

So much for American factories.

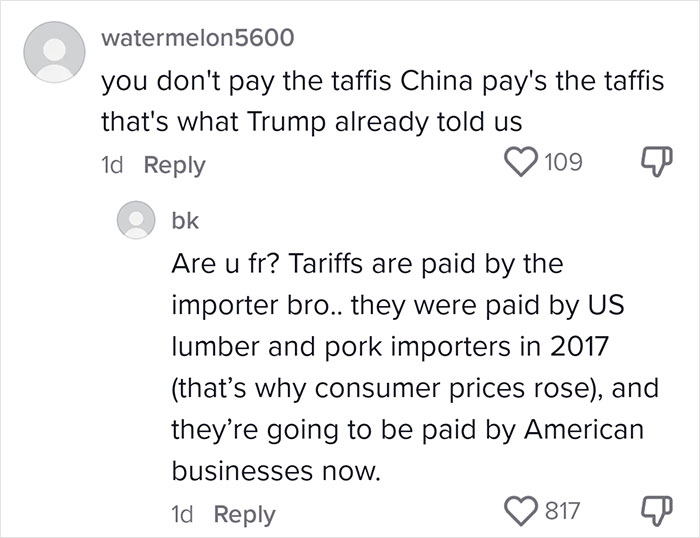

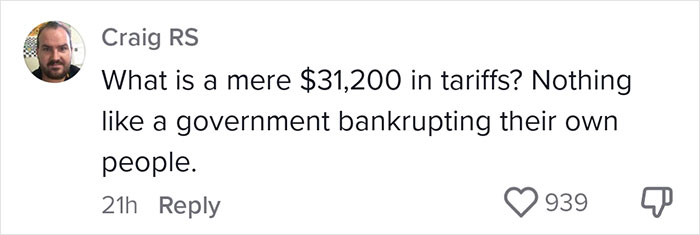

Some viewers seemed to have a lot of misconceptions about how tariffs work

Thanks!

Check out the results: