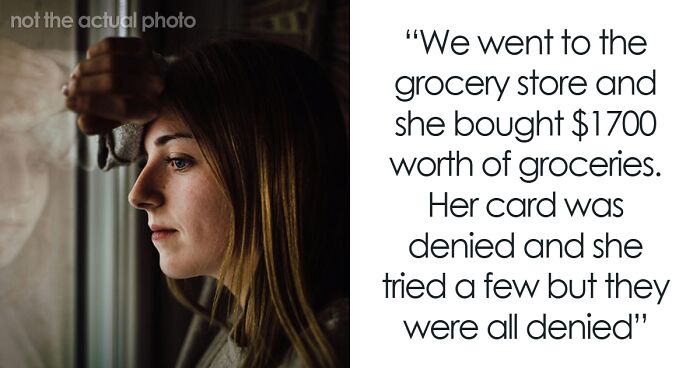

Oblivious to her debt, the bride-to-be went shopping for groceries so she could cook for her guests.

The brides sister refused to help her out because shes tired of her family asking her for money.

And all hell broke loose.

The personal finance company alsorevealedthatcredit card debt in the U.S. totals a whopping $1.17 trillion.

More than half the couples that took part inthissurvey said theyd gone into debt to fund their wedding.

The expert believes it canbe a helpful strategy if done responsibly.

The key is to avoid long-term debt and utilize credit card benefits effectively, revealed Lupo.

However, he adds that you should only charge what you could afford to repay during the interest-free period.

There are other options, says Lupo.

These include scaling back on wedding plans, hosting a simpler ceremony, or saving in advance.

Crowdfunding, family assistance, or DIY decorations can help reduce costs without incurring debt, he added.

Weddings are memorable but should not jeopardize your financial stability.

Prioritize your budget and focus on what matters most to create a joyful celebration within your means.

Building an emergency fund and setting up a realistic spending plan can help prevent similar issues in the future.

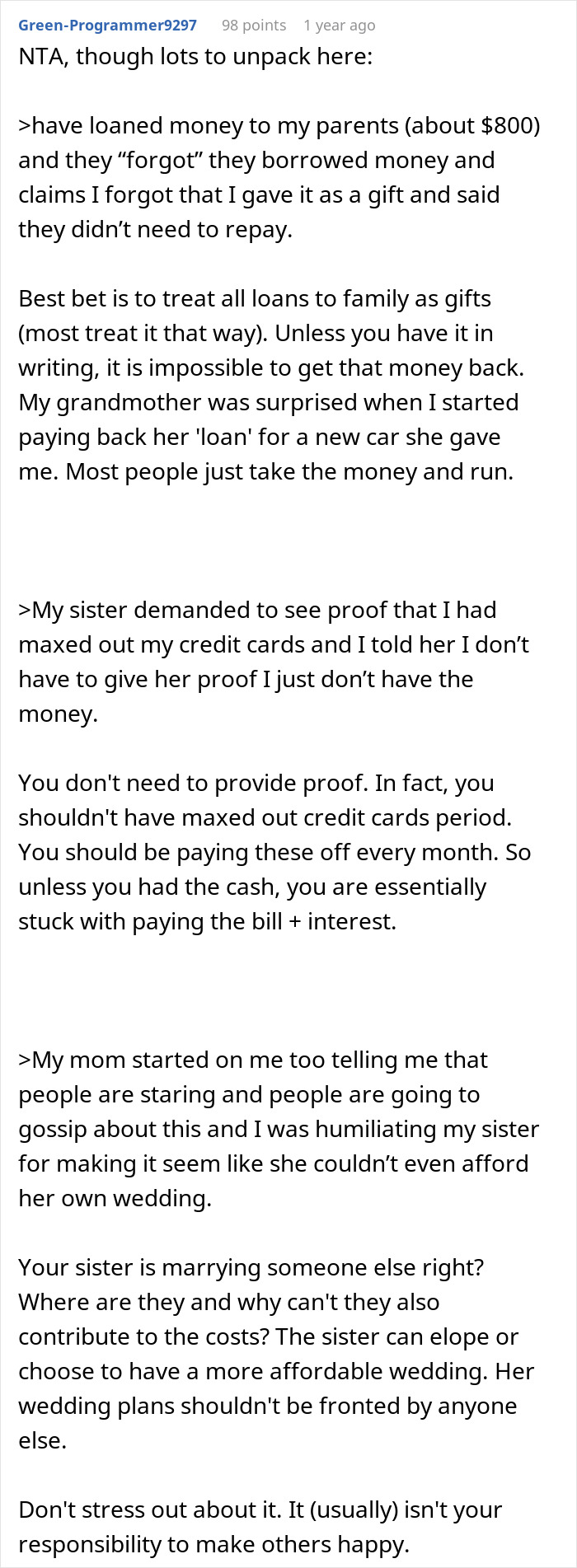

The expert added that hed advise the brides sister toestablish clear financial boundaries with her family.

Then, prioritize paying down the highest-interest debt first, or focus on the smallest balance for quicker wins.

Alternatively, you might explore personalloansto consolidate your debt at lower interest rates.

Lupo says you should definitely attempt to avoidaccumulating new charges.

confirm to stick to a strict budget to prevent further debt build-up, he added.

Finally, contact your creditors to discuss payment plans or hardship programs if necessary.

He says the first step to avoiding wedding debt is to set a realistic budget and stick to it.

Spend what you could afford, preferably from funds saved and not borrowed, he cautioned.

Avoid relying on loans, as they can quickly lead to long-term debt.

Lupo says hidden costs often catch couples off-guard.

Prioritize the most important elements of the wedding, and cut back on less essential items.

By staying disciplined and planning carefully, you might avoid debt and enjoy your wedding without financial stress.

Check out the results: