But the reality is, its wise to consider all of the possibilities for your future.

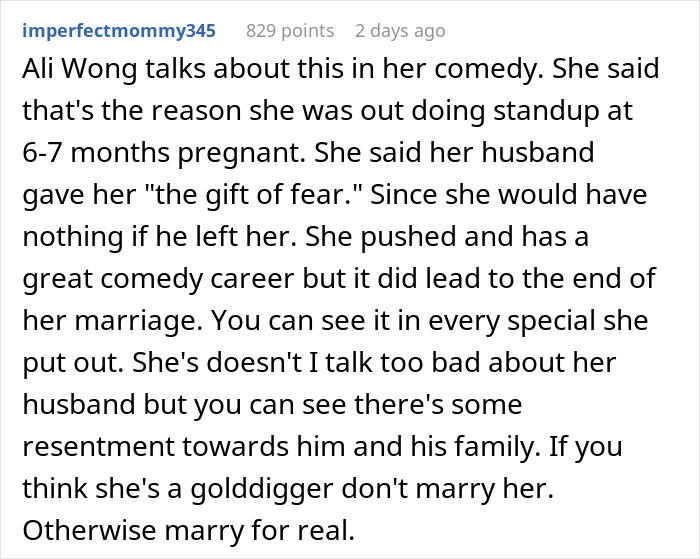

Life is unpredictable, so many couples agree to sign prenups before tying the knot.

Its just a precaution, because if youll be together forever, it wont matter anyway!

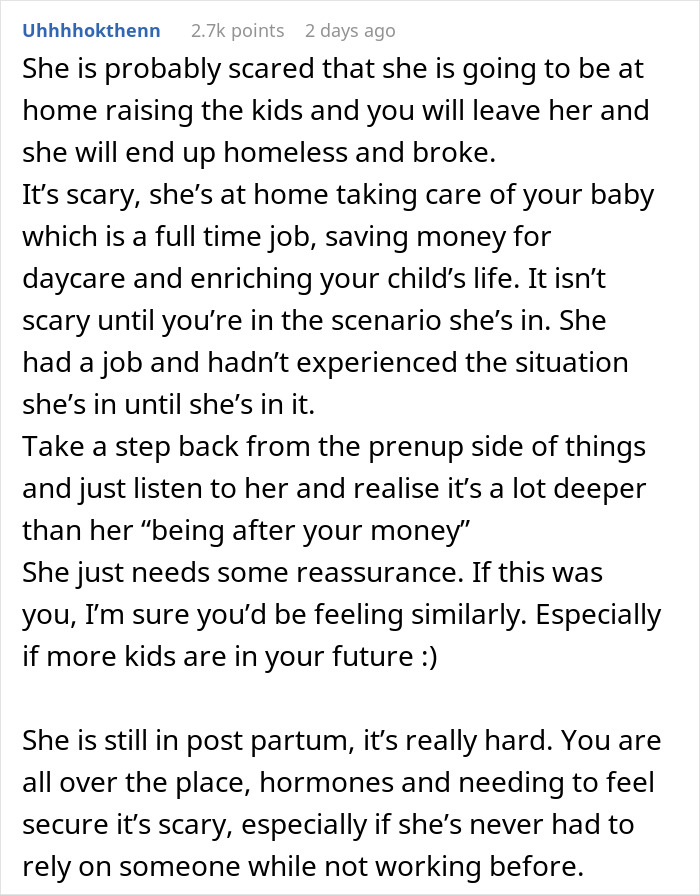

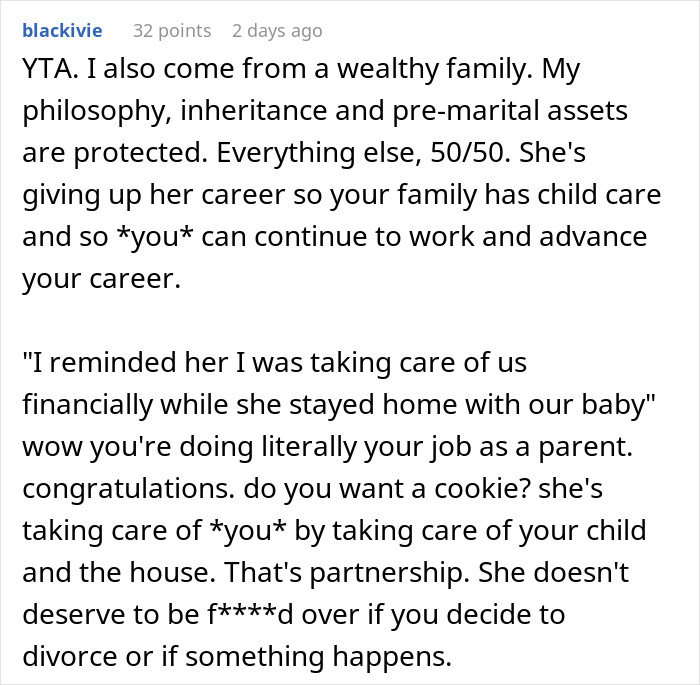

One common reason is the evolution of financial circumstances.

Over the years, the financial landscape of a couple can change dramatically, the expert explained.

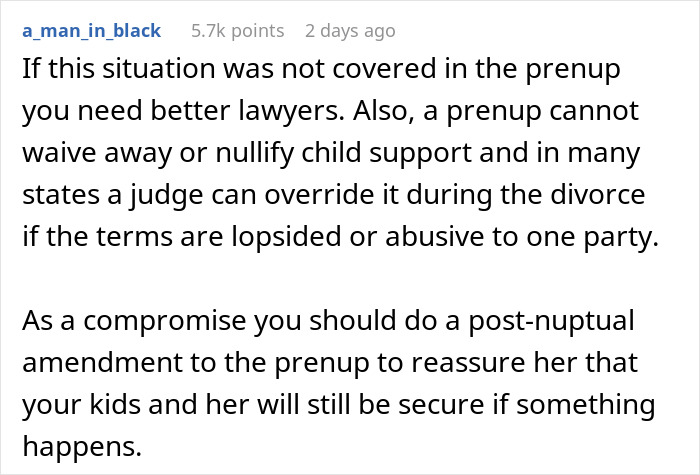

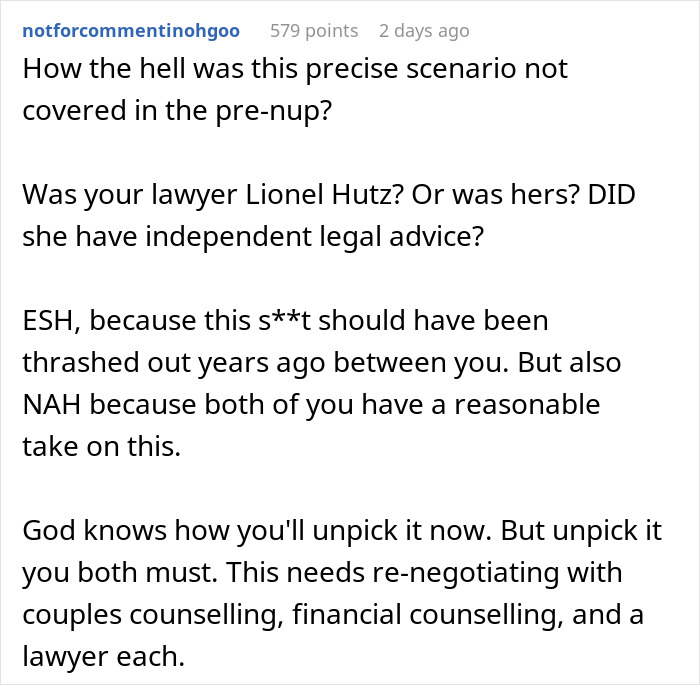

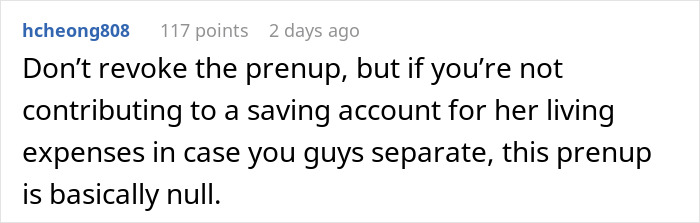

A good prenup will have already addressed many of these scenarios.

Again, a well drafted prenup will likely have taken many of these possibilities into account.

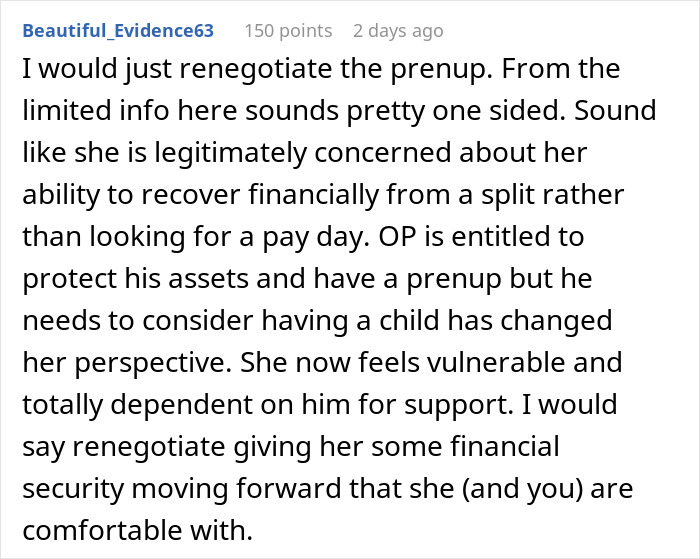

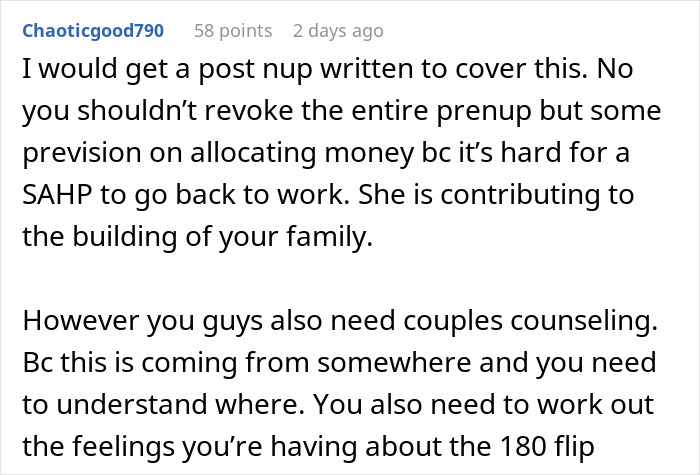

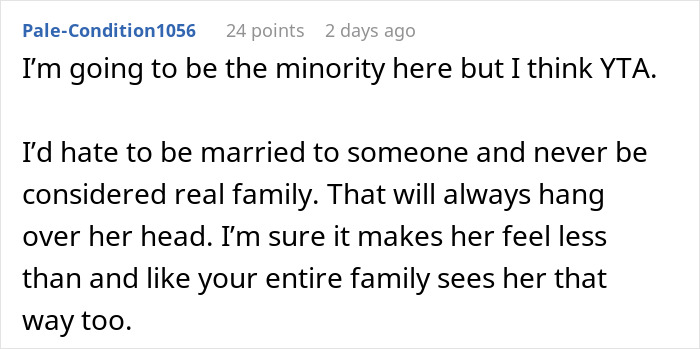

First and foremost, both parties must mutually agree to any amendments or changes.

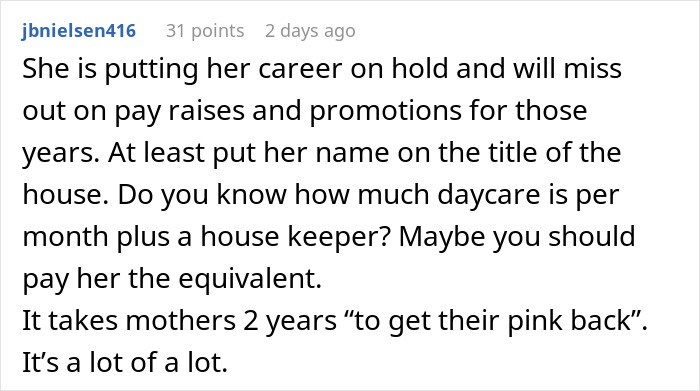

The process typically starts with open communication between the spouses about their desires and concerns.

They should discuss why they feel a change is necessary and what specific amendments they want to make.

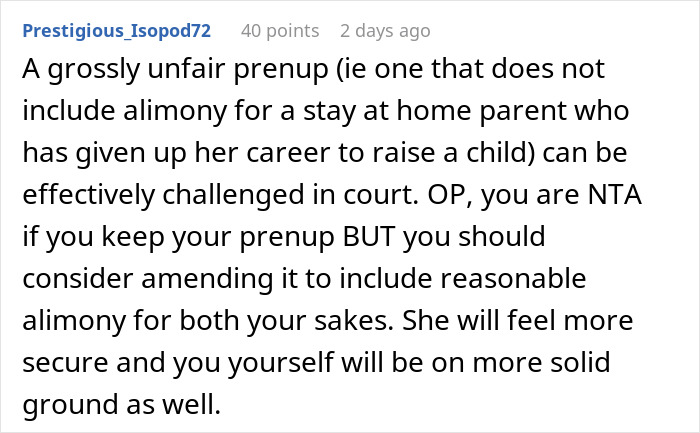

These include ensuring terms are not unconscionable and getting signatures notarized.

That is where a prenup modification comes in.

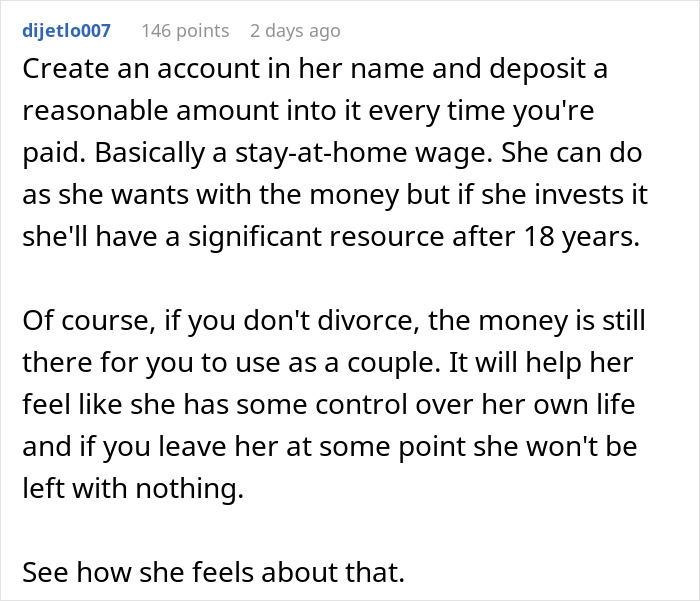

Postnups are increasingly popular among married couples who want to align on their assets and debt.

A postnuptial agreement can supersede an existing prenuptial agreement.

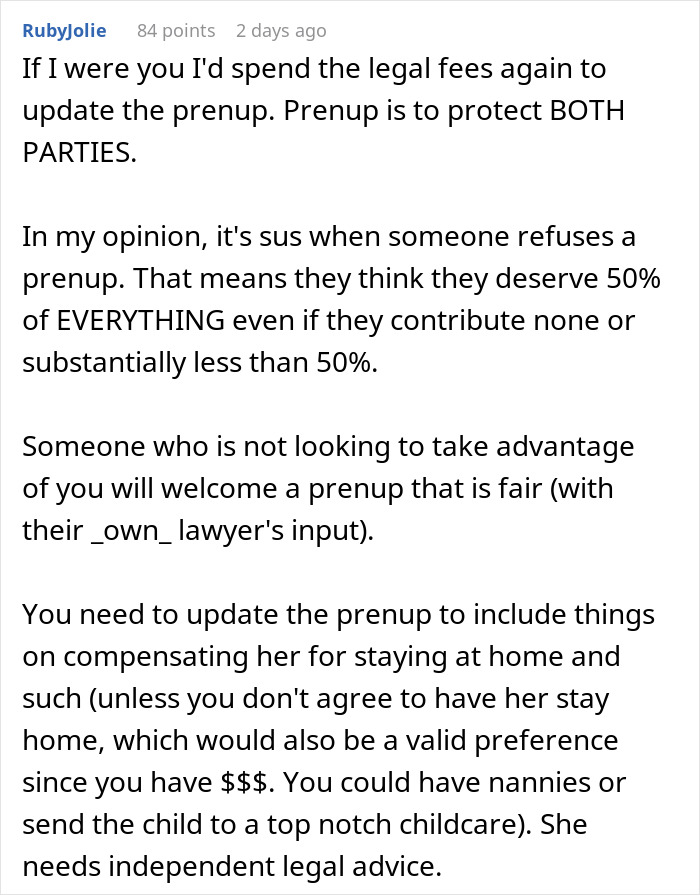

Julia also shared some advice for this particular couple.

One possible solution that Julia recommends is a Lump Sum Payment or Equalization Clause.

Julia says this clause can offer several key advantages.

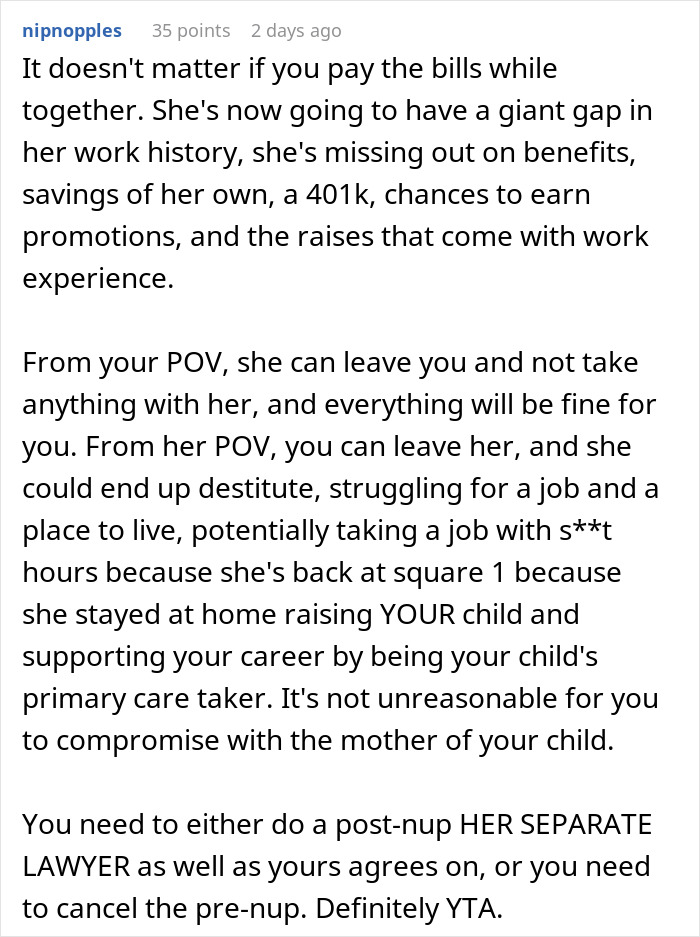

Firstly, it fosters a sense of wealth equalization.

The wealthier partner may exercise more control, either intentionally or not.

The concept of an expiration date can be particularly relevant for parents, Julia says.

The couple may recognize that, by fifteen years, their lives and values have evolved.