Share

Owning real estate is a goal for manyif not mostof us.

Seeing these struggles, somefamilymembers decide to step in and help them out a little bit financially.

However, this sort of help can lead to a lot of envy among siblings.

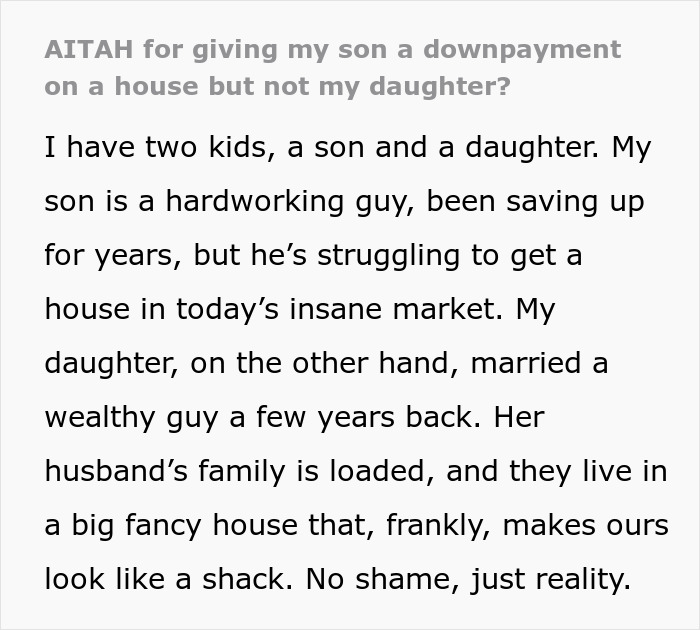

However, seeing this, the mans daughter feltenviousand like he was playing favorites.

She had married into wealth and was set for life.

Read on for the full story.

Youll find his insights below.

Dogen is the founder of theFinancial Samuraiblog and the author of the bestsellerHow To Engineer Your Layoff.

Many young people hope to become homeowners.

Parents should set expectations early, openly discussing their philosophy on financial assistance to manage potential misunderstandings.

Children should notfeel entitled to their parents wealth, but grateful, the expert commented on the situation.

Your first step should be to establish a clear savings plan.

This includes cutting non-essential expenses and automating contributions to a dedicated home-buying fund, he said.

Second, consider expanding your search to more affordable markets or neighborhoods where property values are within reach.

Flexibility in location can open up more options.

Research local and federal programs that might apply to your situation.

Parents love to feel appreciated and valued, not just financially but emotionally.

Building a strong relationship with your parents is the ultimate house hack as an adult!

As per the BBC, it occurs innearly two-thirds(65%) of families, across different cultures.

This favoritism can be damaging to children not just growing up but also well into adulthood.

Blatant favoritism, even when done unconsciously, can make children feel unwanted, unloved, and uncared for.

On the other hand, the simple fact is that no two kids are the same.

But their other wants and needs can look entirely different.

Lets not be naive about that.

But cold hard cash isnt the solution to every situation.

Or they might feel more confident if you accompanied them while they toured their prospective college campus.

So, as a parent, you gotta be able to recognize those different needs and adapt accordingly.

Because the first kid doesnt have the same money problems as the other.

This isnt playing favorites.

It would only be favoritism if there was a long history of putting one persons needs above the others.

Just half a decade ago, in 2019, youd need to earn just $56,800 annually.

Thats nearly double the needed household income in 5 years.

Its no wonder that many young adults are demotivated about their chances to afford real estate.

Location matters a ton.

There is a huge difference in your purchasing power there compared to California.

Thats a massive drop from 59% in 2019.

Its not just an issue with earning potential.

The spike in home prices is also due to higher demand and fiercer competition in the real estate market.

Another major factor is the rise in mortgage rates.

Whats your take on the situation, dear Pandas?

How are you supporting your kids as theyre moving into adult life?

Have you ever had any familyhelp youwith your down payments, college tuition, or bills?

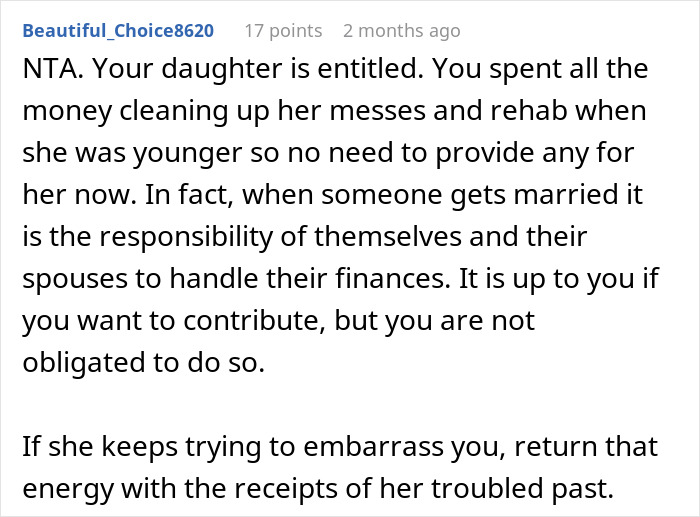

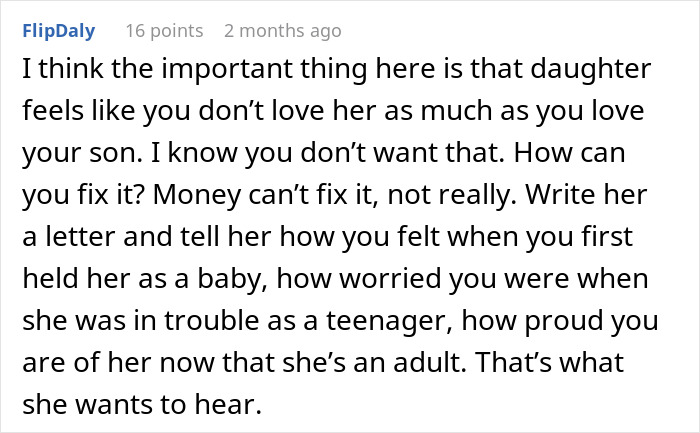

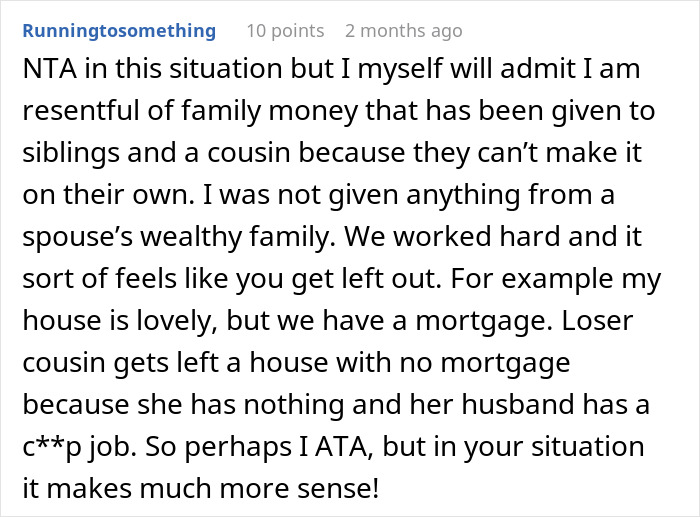

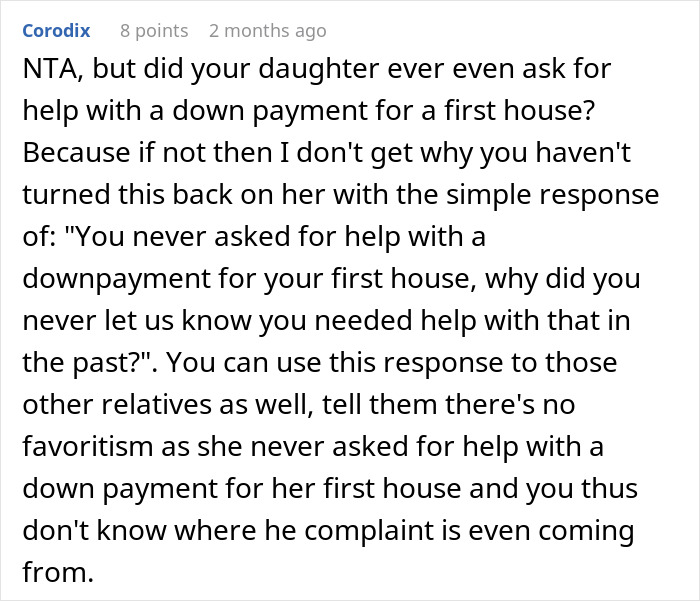

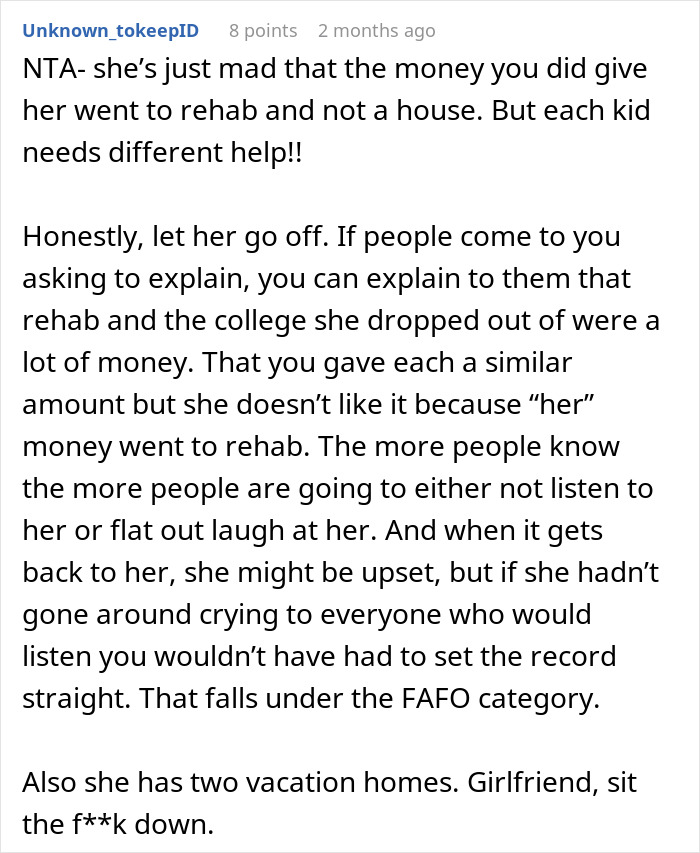

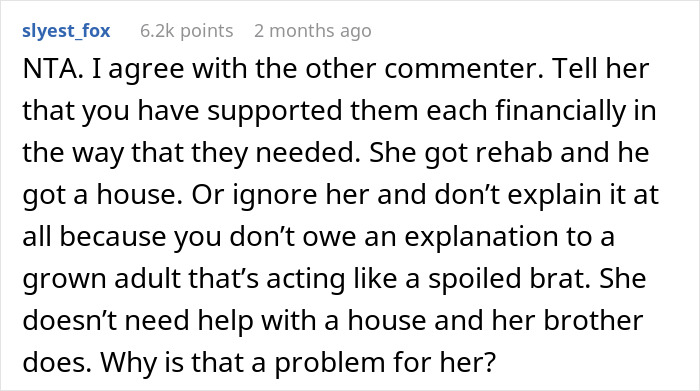

Most readers were on the dads side.

They thought he shouldnt feel guilty about supporting his son.

Check out the results: