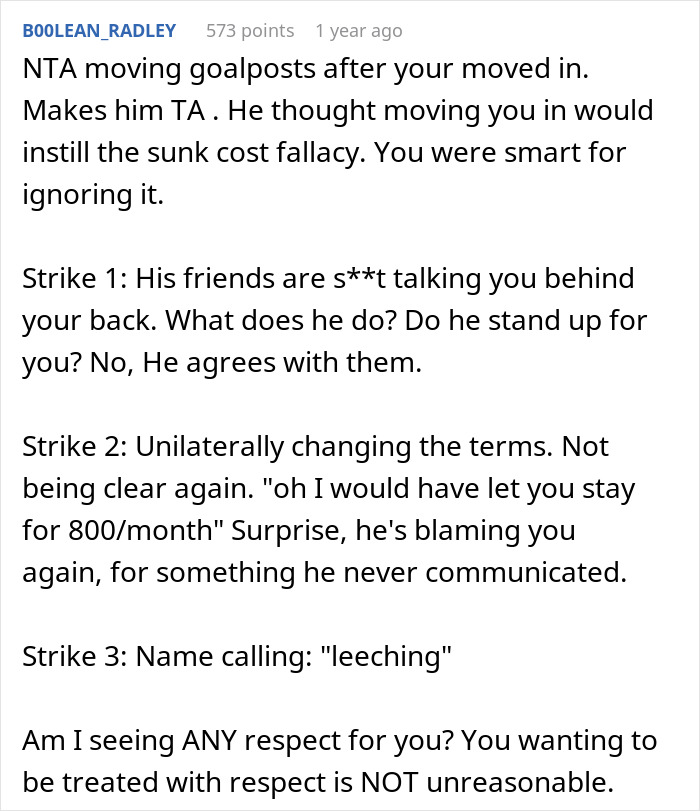

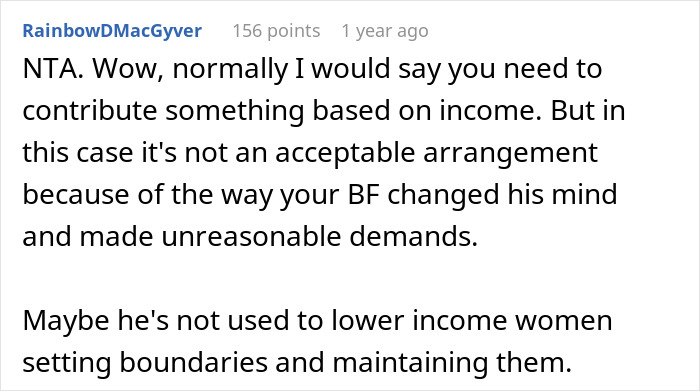

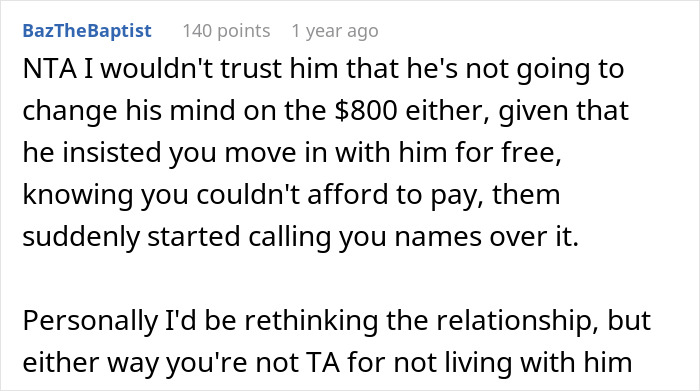

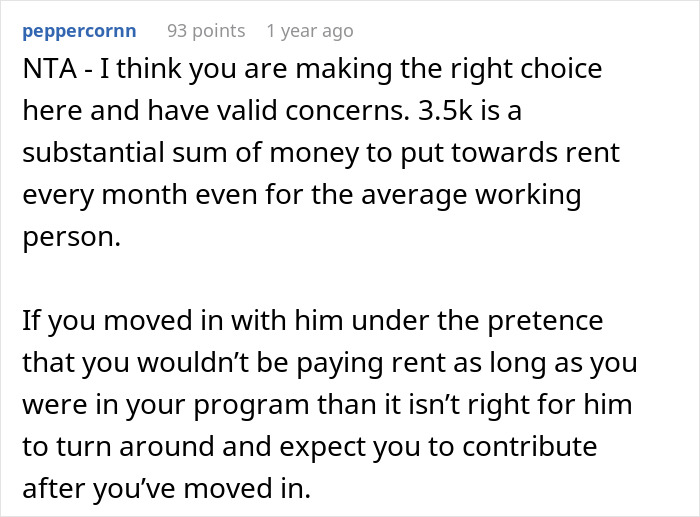

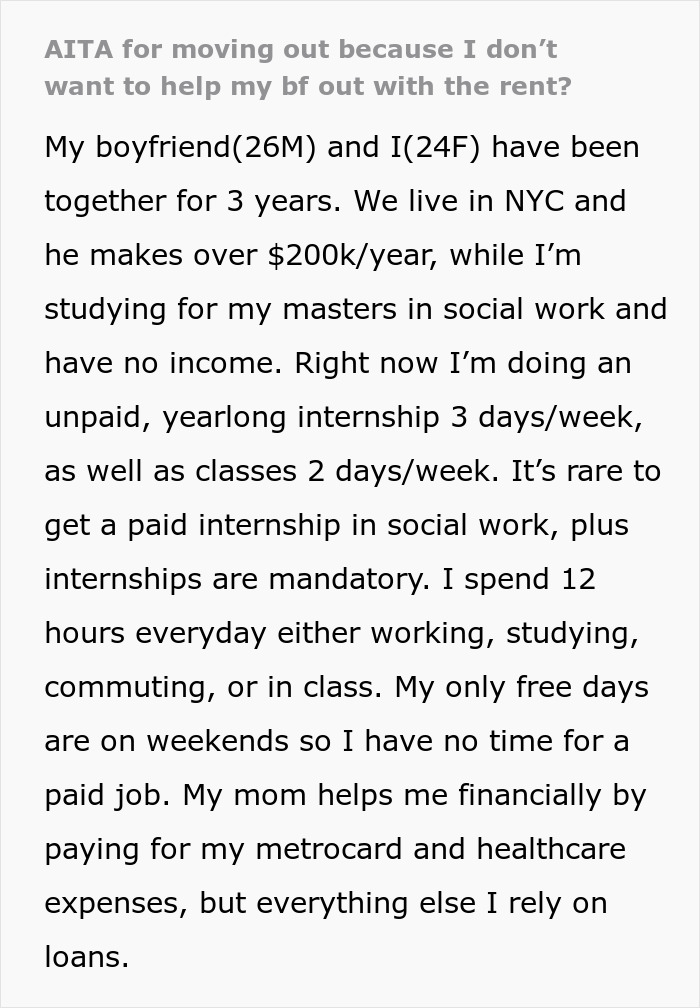

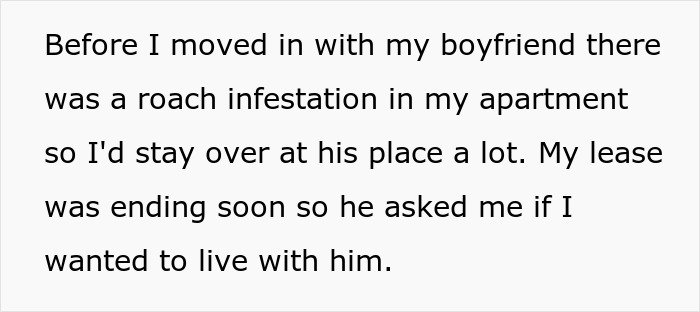

There are cases, however, when a partner volunteers to cover all the rent.

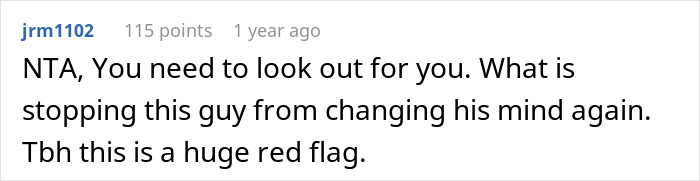

Taken aback and unable to pay this much, the woman decided she would rather move somewhere more affordable.

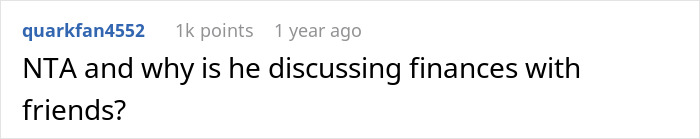

Thats being open and communicating about each others finances from the get-go.

Instead of doing that, however, many couples choose to sus out their potential partners financial situation online.

Yet manypersonal financeexperts say that its crucial for partners to be transparent about money.

Kayla Welte, financial planner at District Capital Management, toldBloombergits never too early to discuss money.

Discuss date budgets and whether you’re able to take that weekend vacation or not.

Making it fun like a date can take the pressure off, keeping the conversation light and productive.

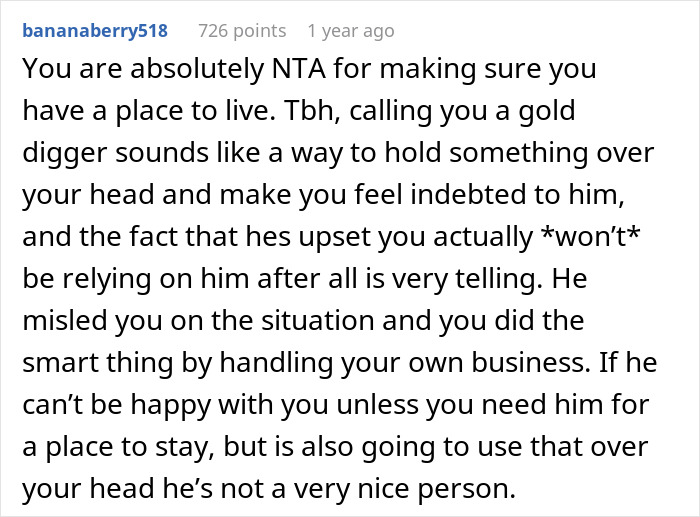

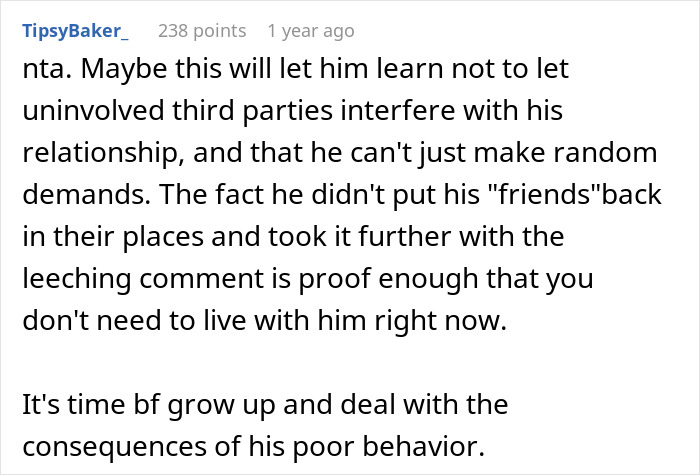

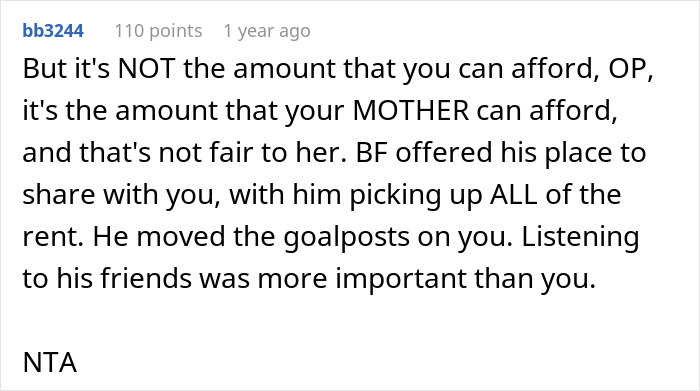

However, in reality, income gaps between partners often lead to arguments and misunderstandings between couples.

Relationship expert Susan Winter toldInsiderthat a significant income disparity can strain a relationship.

Traditionally speaking, money equals power.

And the one with the power is the one who controls the relationship.

They should also evaluate what exactly makes them feel this discomfort.

Also, the fact that youre making less doesnt mean you cant contribute.

There are three different ways couples candistribute income.

The first one, of course, is the 50/50 model, where each person contributes equally.

However, fair doesnt always have to be equal.

Then the proportional model would be appropriate.

If one partner earns more, they should be contributing more.

A good way to calculate this is to work out each persons share of the combined income.

Lets say that one person earns $30k and the other $50k.

The last technique is all in.

Thats when both partners put their salaries together and cover expenses from the joint account.

Check out the results: