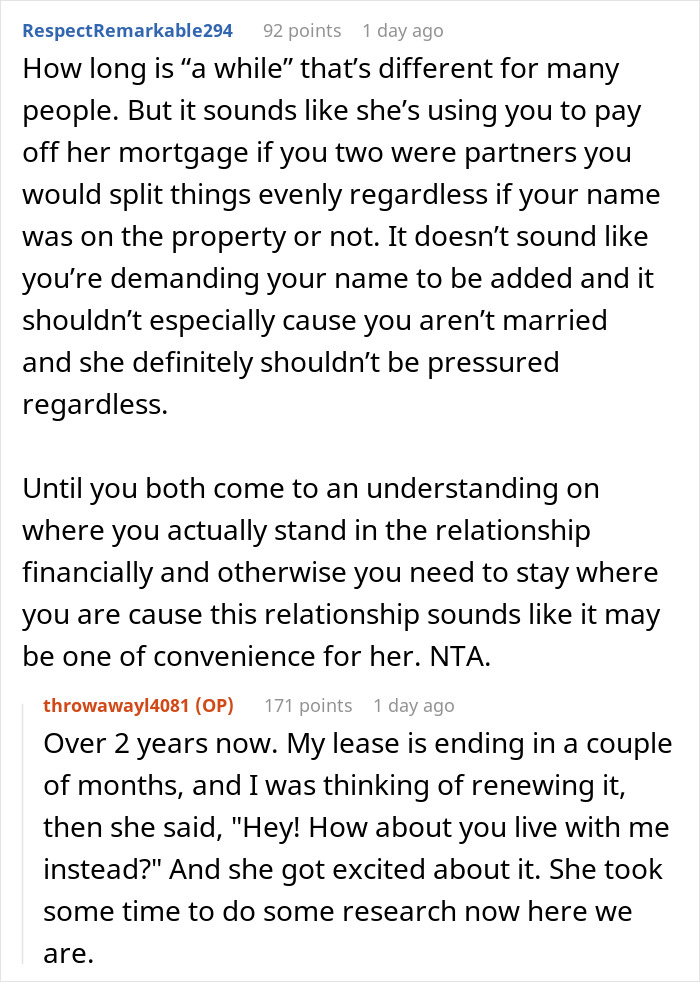

Last week, Reddit userThrowawayl4081made a post onr/AITAHabout a dilemma hes facing with his girlfriend.

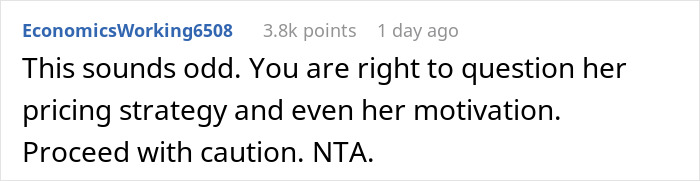

The YOLO/Carpe Diem person always seems to attract the Frugal MacDoogal and vice versa, she toldBored Panda.

I believe that finance is an area where the saying Opposites attract!

together in a conversation.

Then you’re free to find creative ways to use each others perspective well.

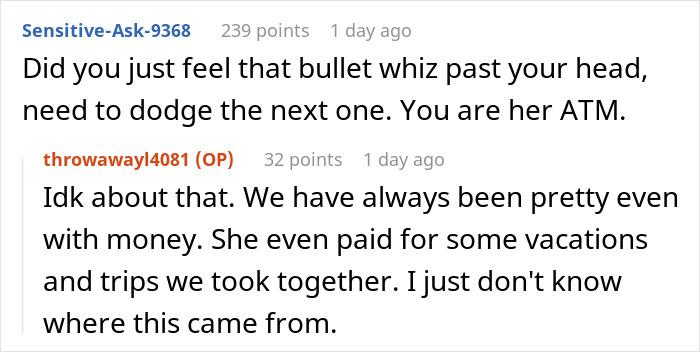

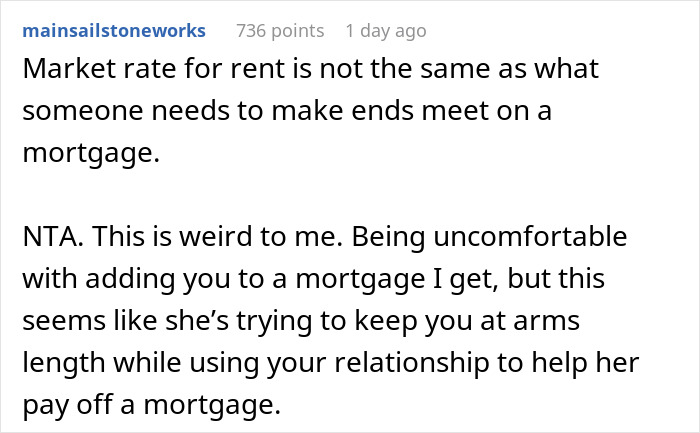

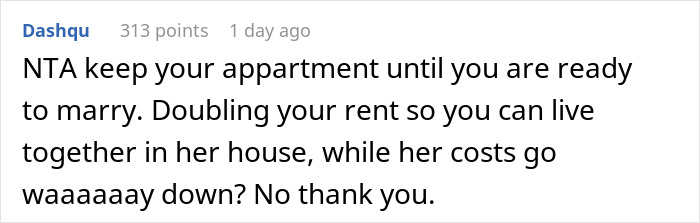

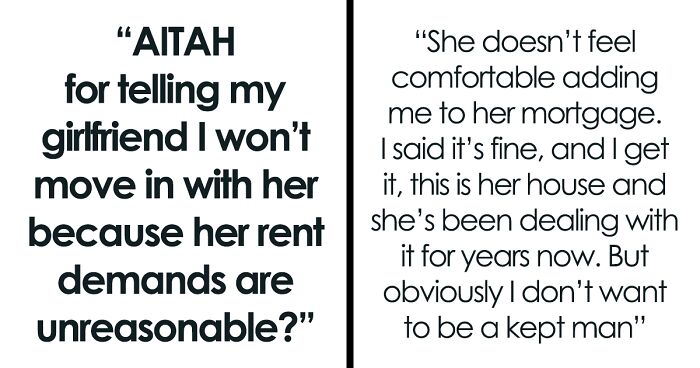

Thelandlord/tenantarrangement may seem cold, but it could meet the interests of both parties.

Since the girlfriend owns the house, she bears all of the associated risks.

If a dog-walker slips and falls on theicy driveway, shes the one who is liable.

But that means the guy shouldnt be paying for a snowplow service, either.

But for the time being, that doesnt concern the author of the post.

Its unfair to expect these returns if you are not bearing any of the risks.

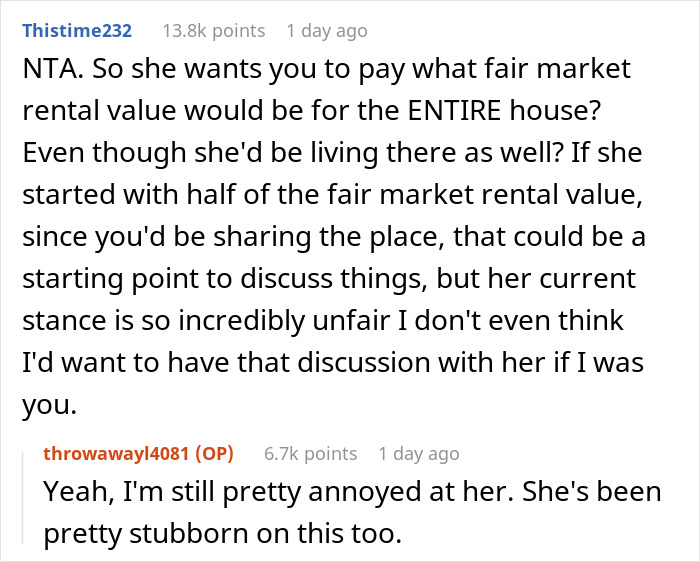

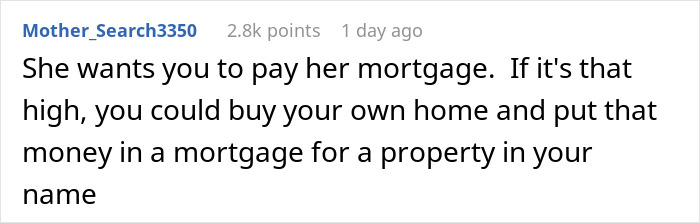

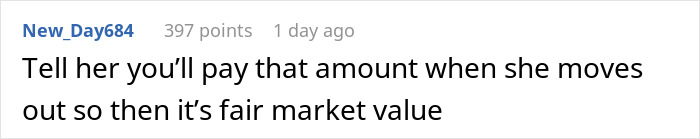

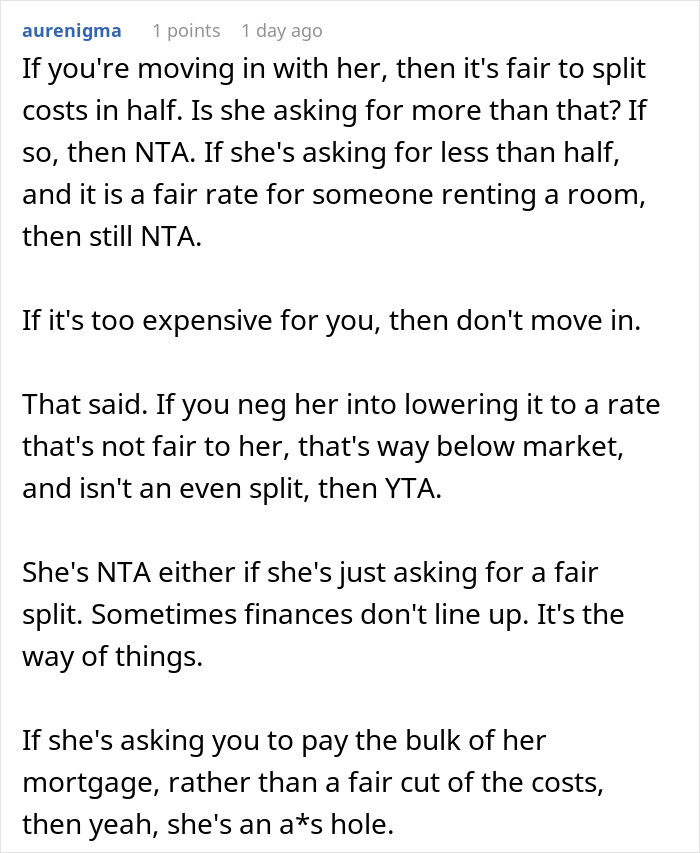

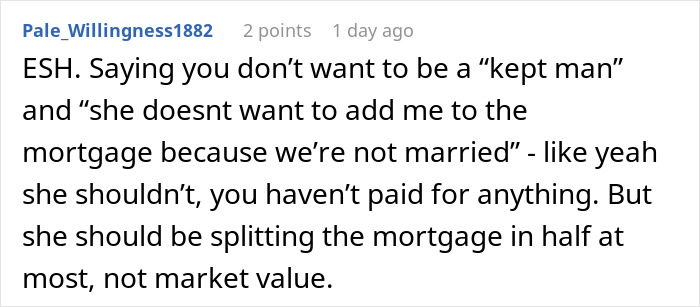

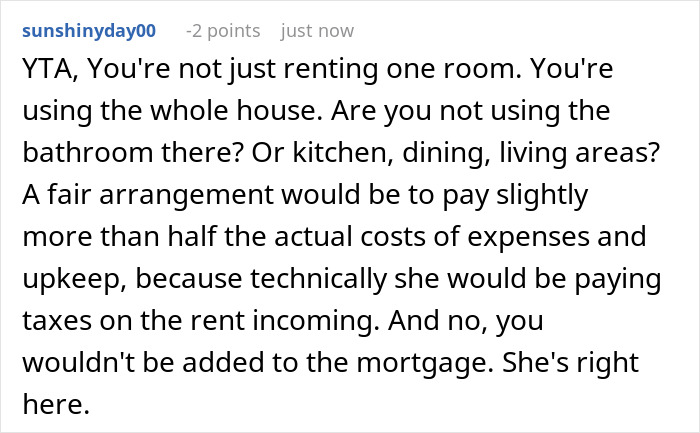

The tricky part is deciding how much to pay the girlfriend for his rent.

To determine the monthly payments, the couple could check out current rental rates for similar properties nearby.

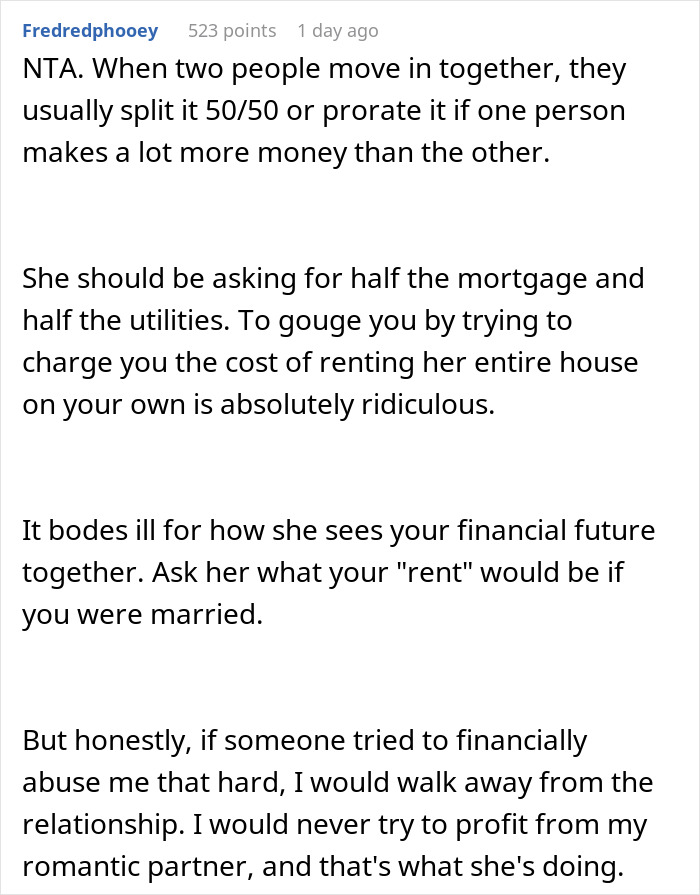

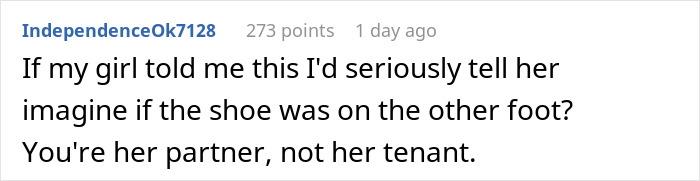

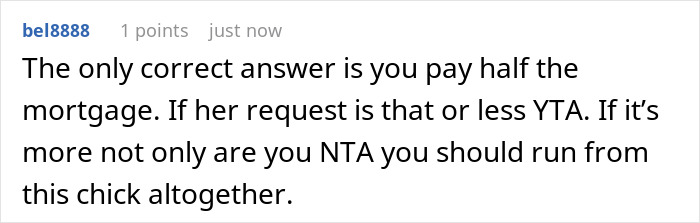

When discussing cohabitation, couples take different approaches, Dr. Zepeda said.

Some couples that are still in the early stages split everything 50/50, regardless of whose income is larger.

Other couples that might be further along in their commitment level do a percentage-based approach (i.e.

if someone makes 70% of the household total income, then they split the bills 70/30).

And some couples even completely merge their finances (i.e.

they put all income into one account and pay all the house bills from that account).

If expectations are clear, it helps to avoid hurt feelings, she explained.

So at least this particular couple tackled the question sooner rather than later.

However, they might be missing the bigger picture.

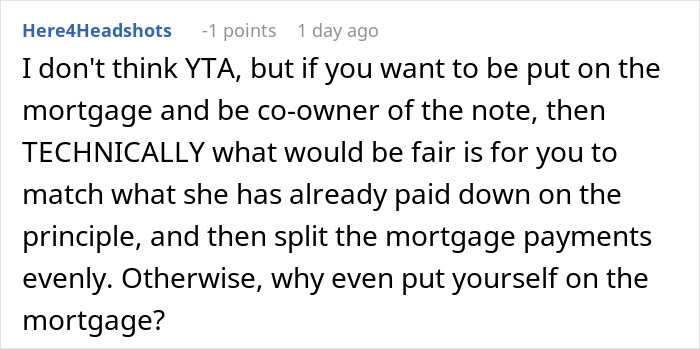

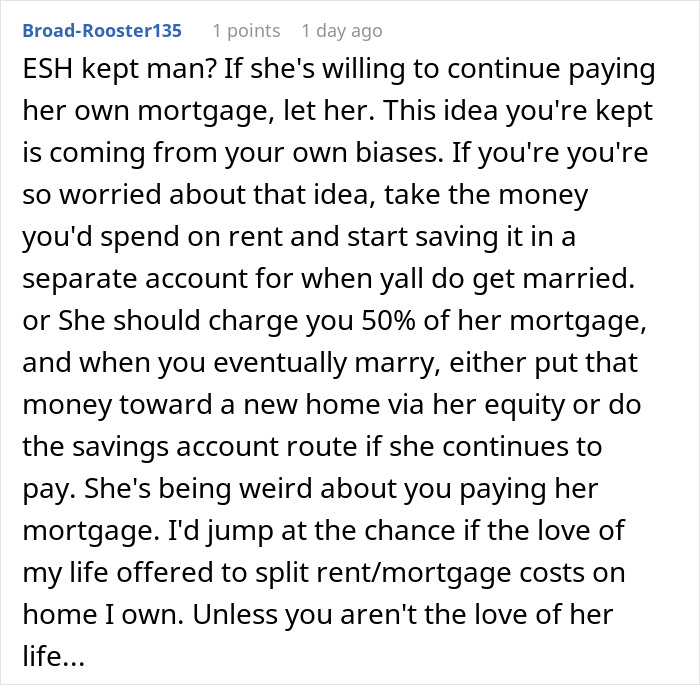

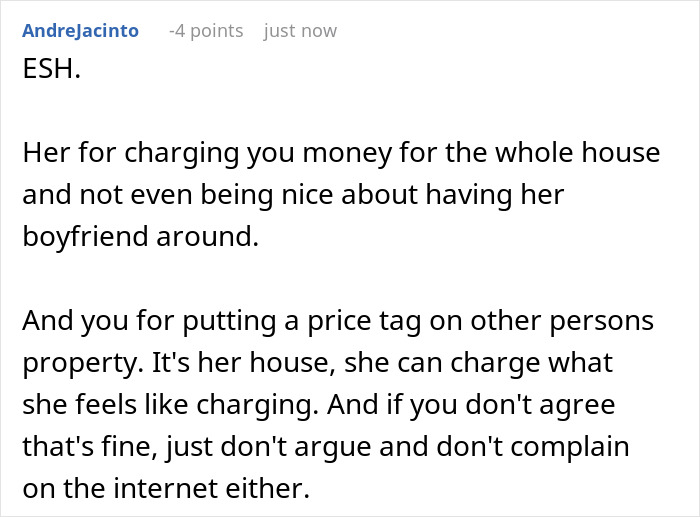

Check out the results: