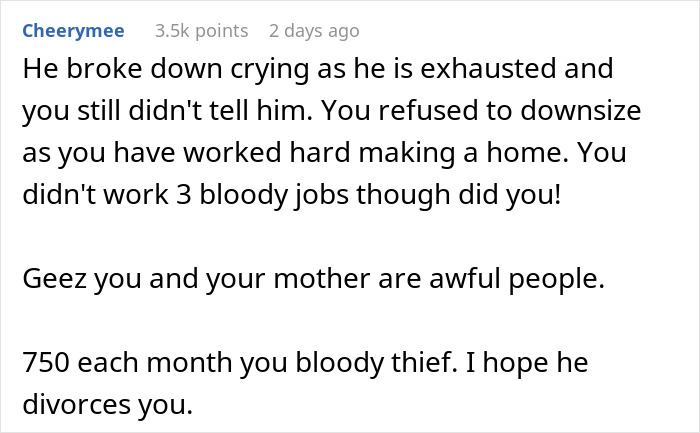

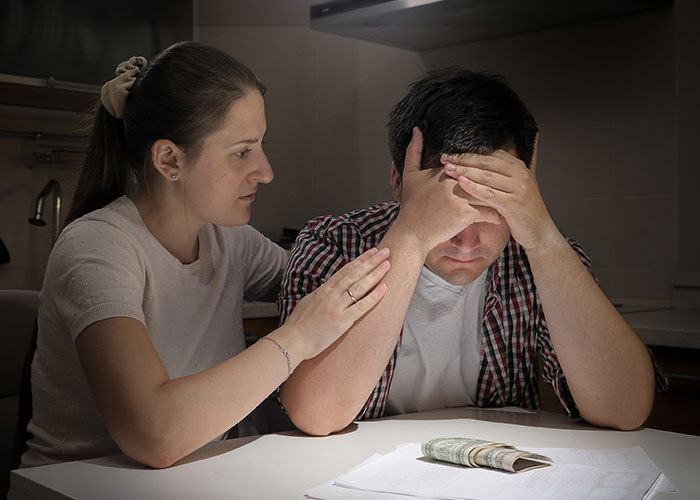

He began to think she was treating him like a predator, sucking his money dry.

But despite her excuses, he left the house feeling hurt in every way imaginable.

These four little words in wedding vows can carry a lot of substance.

Some spouses like those in this story might feel comfortable having a household with one income.

Coambs tells us that despite these difficulties, a one-income household can be achievable.

Beforehand, the two adults should practice and learn how to communicate openly about their finances.

I encourage both adults to think in terms of teamwork and collaboration.

The adults creativity and collaboration are the best ways to figure out ways to make a one-income household successful.

Respect for both partners contributions to the household is also essential.

Paivas approach encourages couples to focus on strategic planning and financial resilience.

Being a partner is challenging.

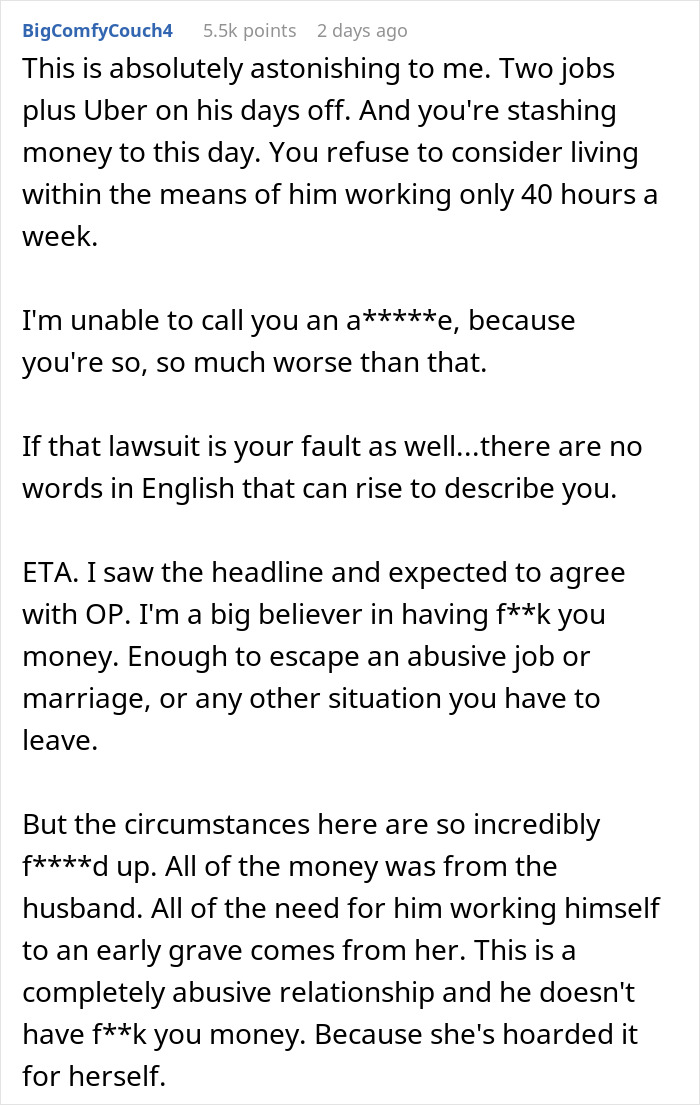

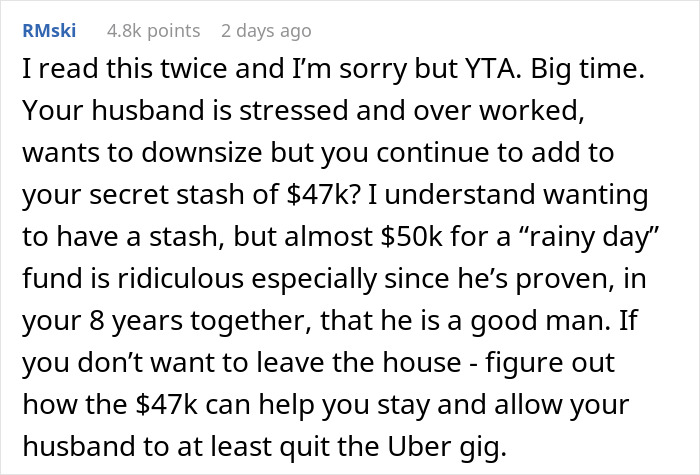

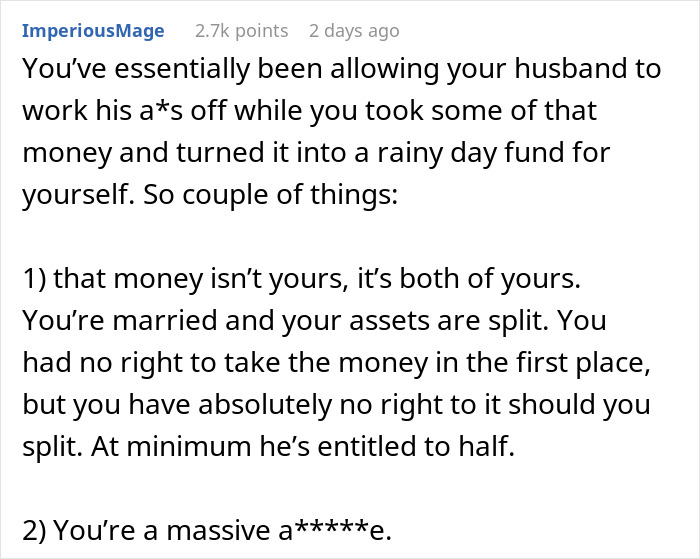

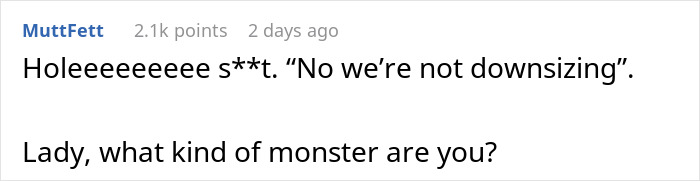

This happens when a couple that has chosen to combine their income lies to each other about it.

They also may overhear stories in which people advise not to trust others with their money.

Financial infidelity is a symptom of underlying relationship issues and patterns like insecure attachment.

Paiva observes that many individuals may not even realize theyre engaging in financial infidelity due to its pervasiveness.

It is more tedious sometimes than physical or sexual betrayal because more people usually discuss romance than money.

Together, we can navigate this challenging terrain and foster a stronger, more transparent economic partnership.

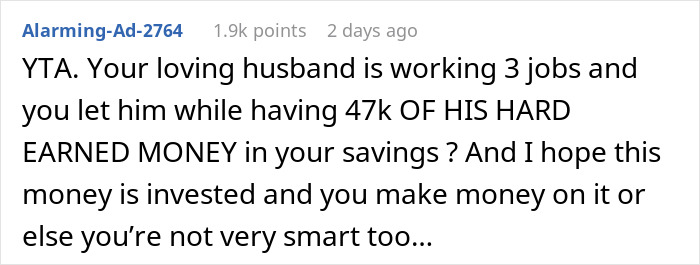

Building and rebuilding trust is an ongoing process after financial infidelity.

The couple may fix the money issues but their feelings of distrust and shame can linger.

Rebuilding financial trust after a financial infidelity incident requires patience, understanding, and a commitment to transparency.

By prioritizing open communication and mutual respect, we can lay the foundation for resilience and trust.

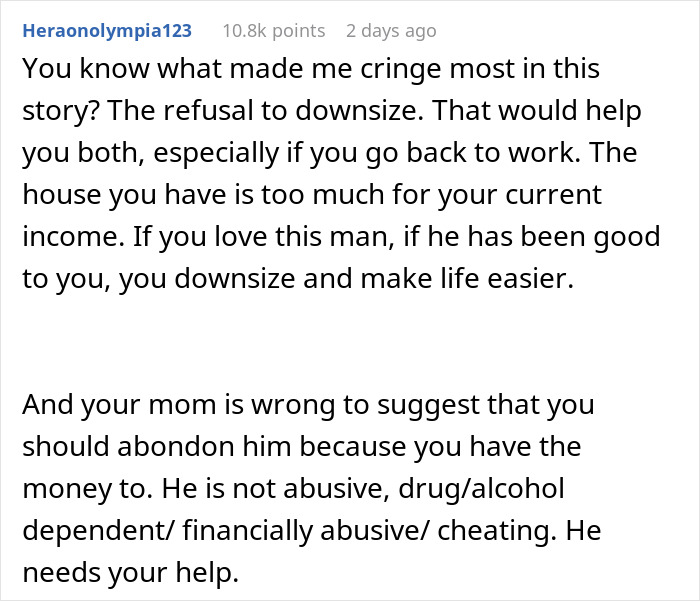

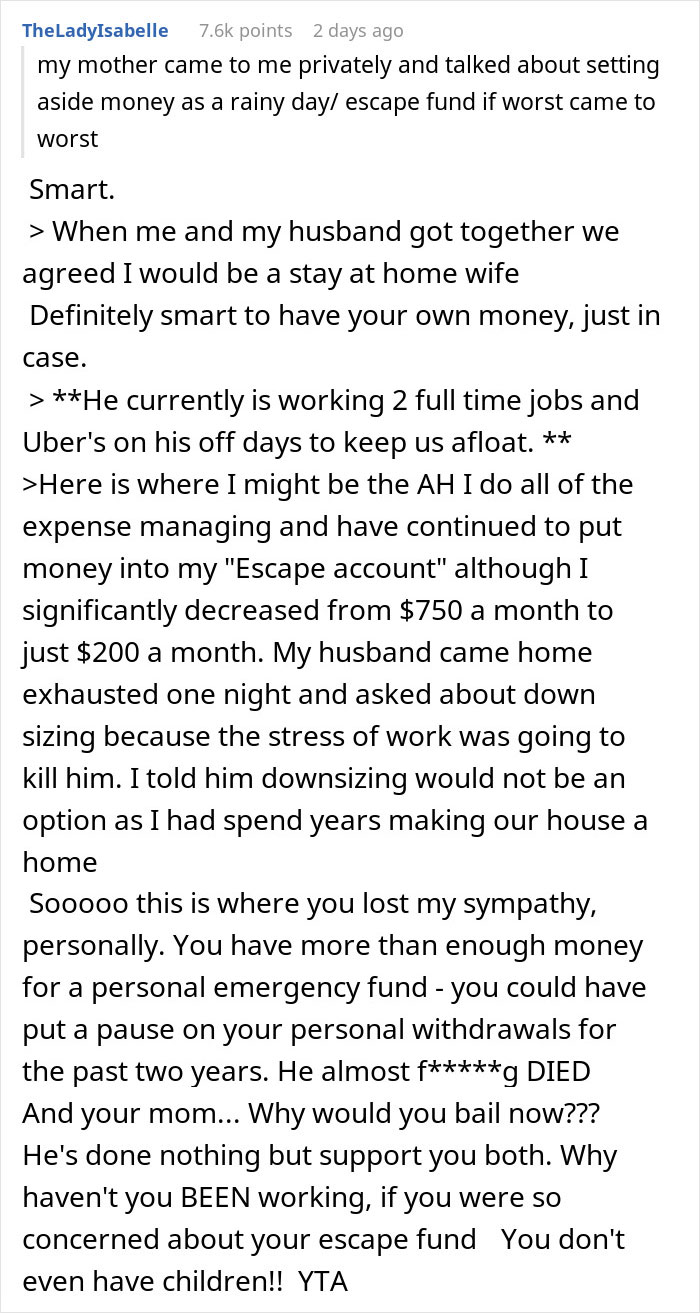

The wife was titled wrong, to say the least

Thanks!

Check out the results: