So it can be helpful to hear the stories of others mistakes to avoid them ourselves.

Caleb:What do you mean you maxed it out?

Max it out ormaxedit out?

Rylie:I got confused with the credit debt and the credit limit.

So my parents got me a credit card.

And I ended up getting a max credit limit of $8,000.

So I could spend up to $8,000.

Thats what that means, right?

Oh, Ill spend the money, dont worry about it, its just a credit card.

So I would pay and pay and pay and pay.

And then I called my mom one day, and I wanted her to be proud of me.

So I was just like, Hey, Ive got $4,000 credit on my credit card.

And shes like, Credit limit or credit debt?

I was like, Whats debt?

And shes like, Oh, thats bad.

Im like, Oh, really?

So its $4,000 debt, then.

Shes like, Thats bad.

Why did you do that?

Im like, I thought that was good.

Shes like, No, your credit limit at the time was $8,000.

So I was like, Okay, well, the credit limit is $8,000.

Thats good, right?

And shes like, Yes, but you are $4,000 in debt.

Caleb:When was this?

Rylie:Last year.

Caleb:Okay, and then what?

Rylie:And then theyre like, Screw it, youre not gonna pay this off in time.

Give it to me.

So my parents took it and theyre still currently paying it off right now.

Rylie:Theyve been paying it off from $4,000.

They just basically gave up and said Youre not gonna pay this in time.

So just give it to me.

And then well payit.

And then whenever…

Caleb:Listen, I dont want you to suffer in debt.

But is that helping you?

Is that teaching you?

I dont think so.

I think theyre done.

That sounds like some form of enablement to me.

Im like, okay, cool.

And you could use it, and then you could pay that off.

Caleb:Why are they just like funding [your life]… You make money?

Caleb:Wheres the money going where you cant take care of yourself as an adult?

You wanted to move out, like an adult.

Caleb:But you have to rely on them taking care of you?

Why cant you take care of yourowns**t?

Rylie:Well, I can.

I mean…

Caleb:Then why dont you?

Rylie:I do, I do.

Caleb:Thats insane, you cant afford to live.

You cant afford to go out.

Rylie:Yes, I can.

Caleb:No, you cant!

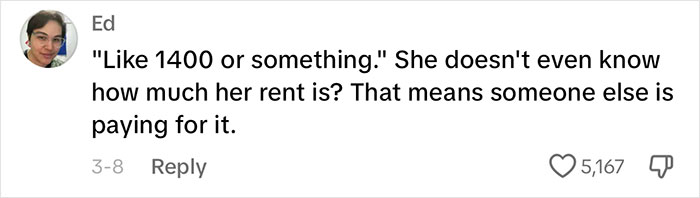

The income that came in was $1,600, rentis$1,400.

Thats your needs, 80%.

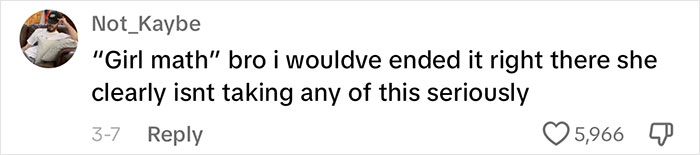

Rylie:Girl math.

Caleb:This is not a joke.

Rylie:Im not treating it as a joke.

Caleb:*Its girl math.

- Math math says its about 80% of your income.

Rylie:Yeah, I mean, we get income from other ways too.

Caleb:Okay, I saw $128 came in from Lackland.

And $263 came in from Cash App.

So even still, your rent of what, again?

Rylie:Almost $1,400

Caleb:Okay.

You cannot afford it.

It shouldnt be higher than 30%.

Rylie:Well, what I do is I go donate on the side, too.

Caleb:Nooffense, you could not move out.

Rylie:I did though.

Caleb:Yeah, but youre not affording it.

And dont say I am affording it, because Ill tell you how youre not affording it.

Theyre paying your credit card bills.

Theyre taking care of expenses that pop up.

You cant afford it.

Rylie:Im not being enabled.

Because your money is going to f**k you.

Partially, this can be seen as a result of some social taboos around discussing money.

How they spend it is often a reflection of what they have seen their parents do.

Its not ascamif a willing and informed adult signed off on it.

One example of this, at least in the US, are the ever-discussed student loans.

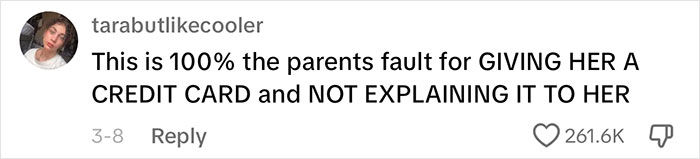

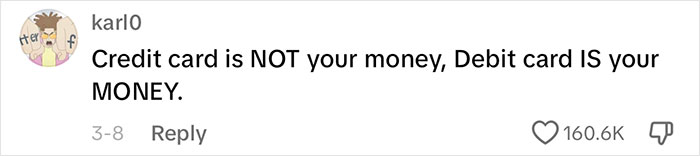

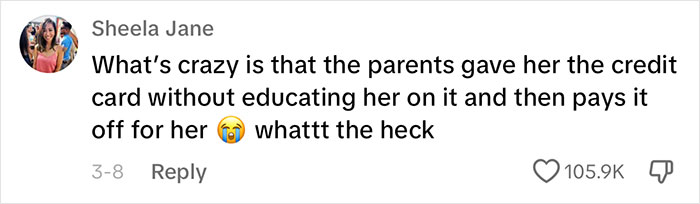

Viewers shared their opinions

Thanks!

Check out the results: