Share

Money is the topic mostcouplesargue about.

According to a 2022 YouGov poll, 28% of Americans in serious relationshipshave disagreementsabout money.

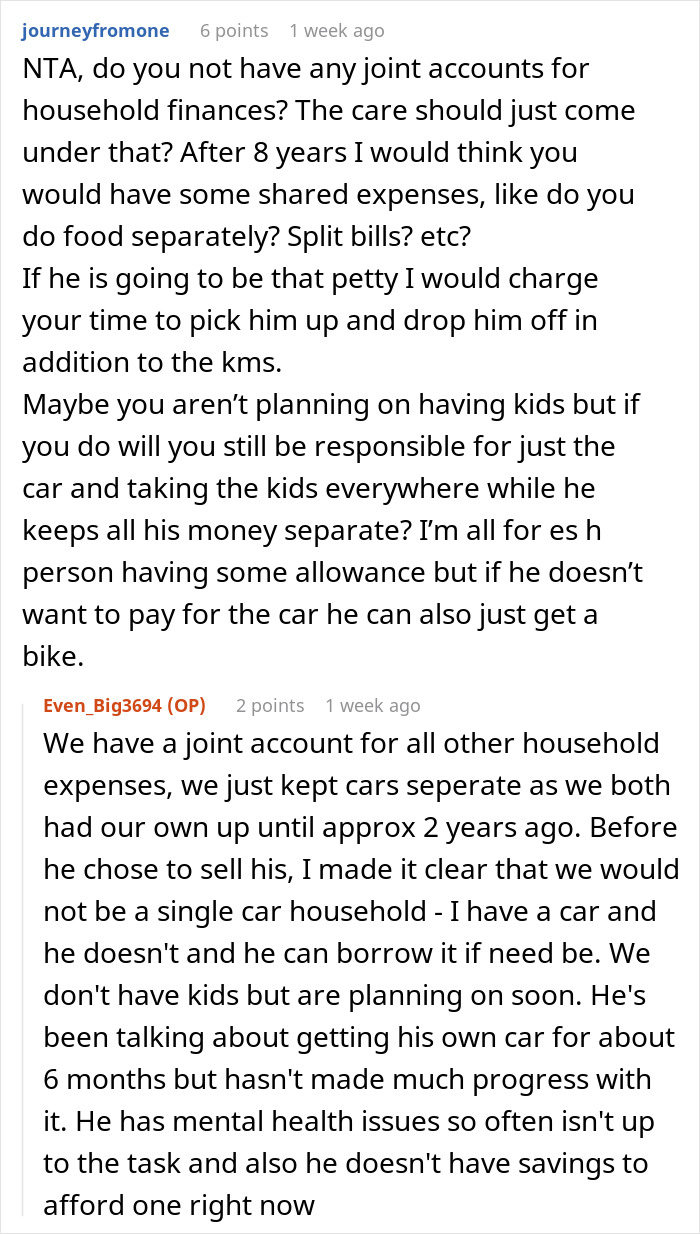

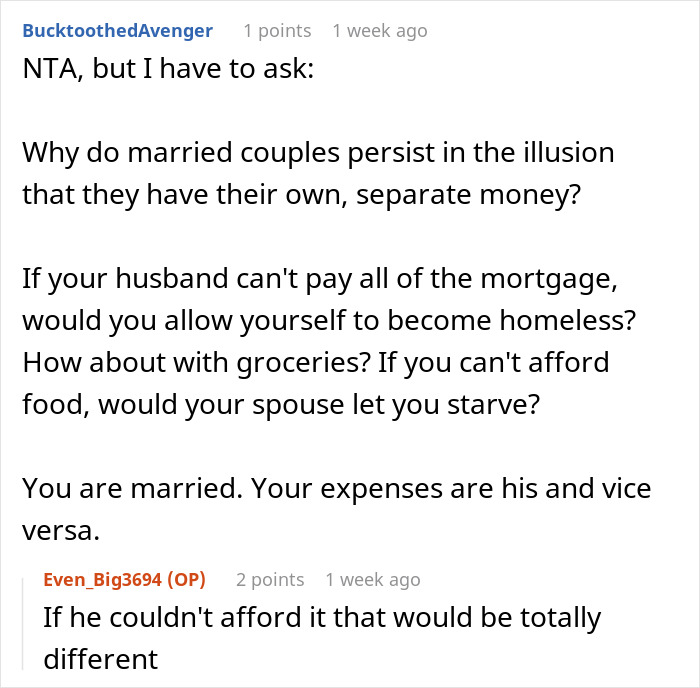

This coupledisagreed about their car.

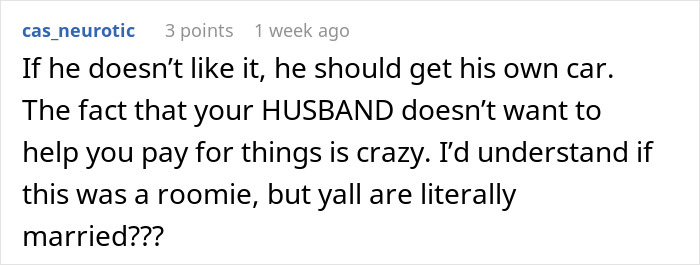

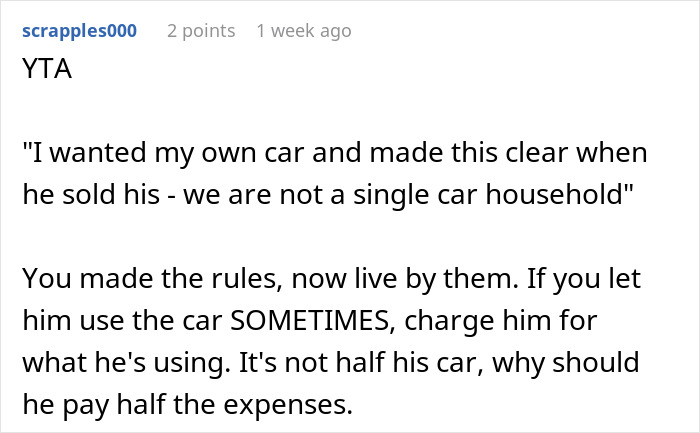

The wife felt that the husband should chip in for its mechanical bills since he uses it regularly too.

Yet he thought that was unfair, as it was technically his wifes car.

Unsure about what to do, the woman decided toask for adviceonline on how to solve this issue.

Vickery also spoke about how couples can make splitting costs a joint investment rather than a transaction.

Read her expert insights about this story below!

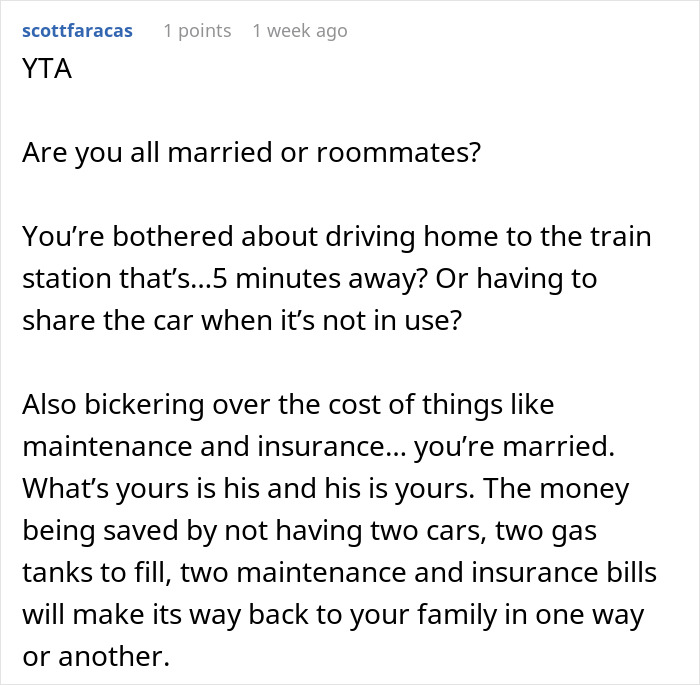

The ways in which we define ownership and financial fairness inrelationshipsalso play a part here.

Money isnt just about numbers, Vickery explains.

It carries meaning tied to our sense of independence, security, and past experiences.

At the heart of the couples argument is not the car at all.

According to Vickery, its about their deeper money narratives.

Before marriage, were often in a phase of heavy growth and self-discovery, she says.

So, the wife views the car as one of her majorfinancial investments.

She views it as more valuable because she worked toward it independently in early adulthood.

On the other hand, the husbands stance is also understandable.

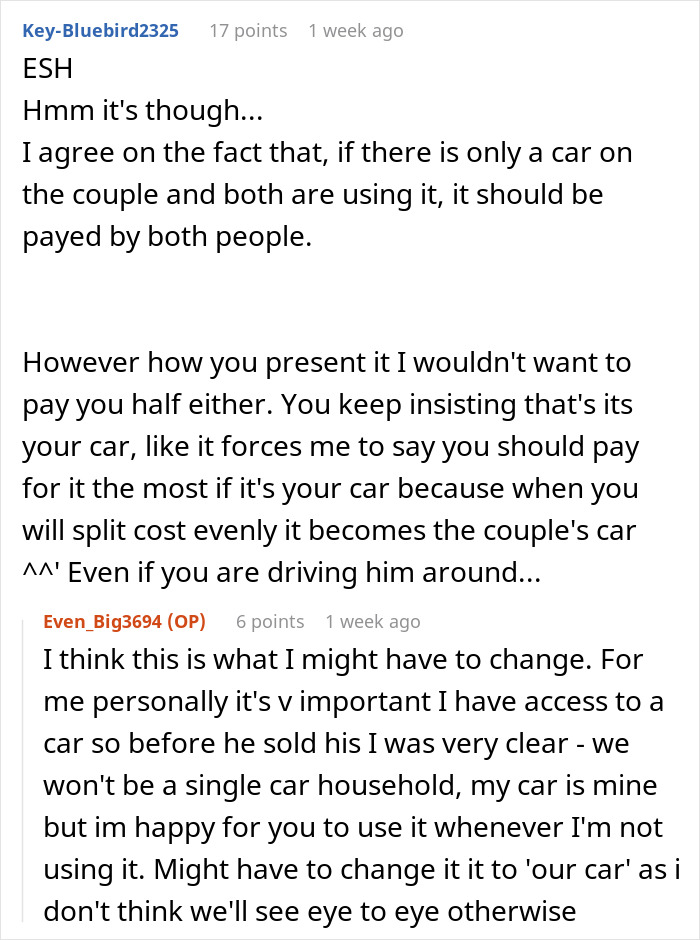

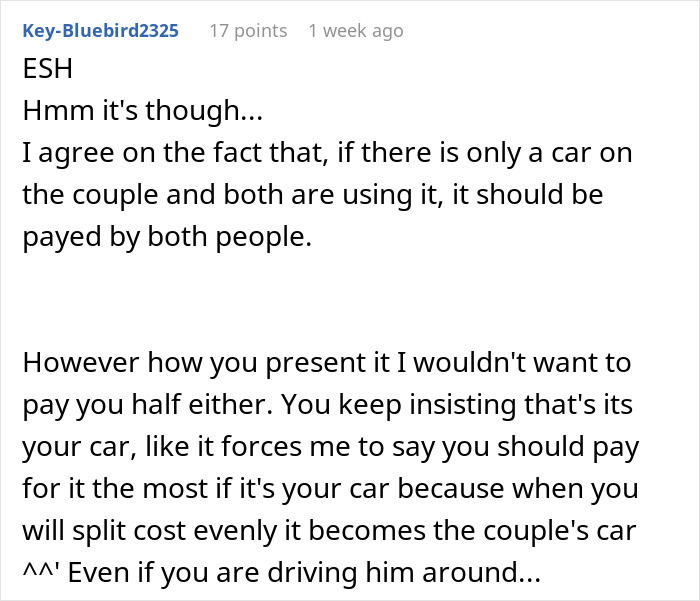

So, how can couples decide whats mine and whats ours when only one person technically owns it?

Vickery says that the couple needs to ask each other a key question.

Image credits:Oliur (not the actual photo)

Instead of thinking Who owes what?

The couples first mistake was that they didnt redefine the cars role after the husband sold his.

Both the wife and the husband would need to challenge their limiting beliefs.

A true win-win comes from shifting the conversation from Who owes what?

to How can we both feel valued and secure in this shared expense?

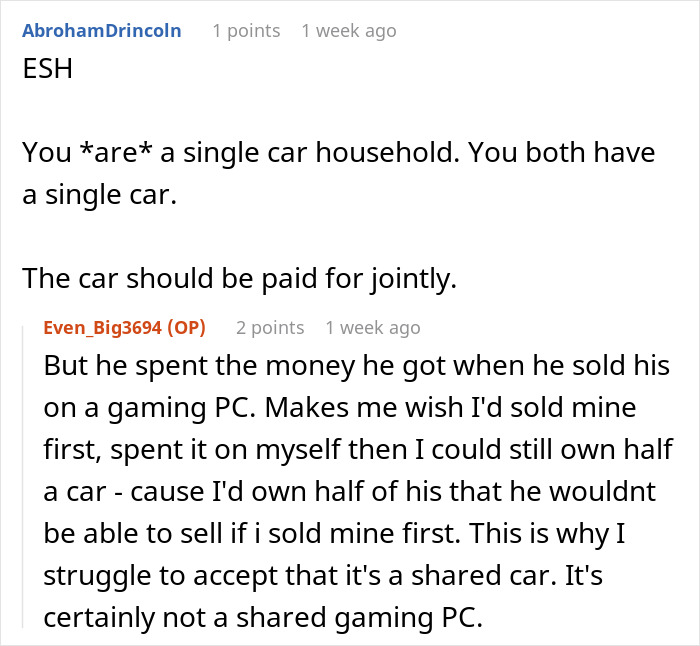

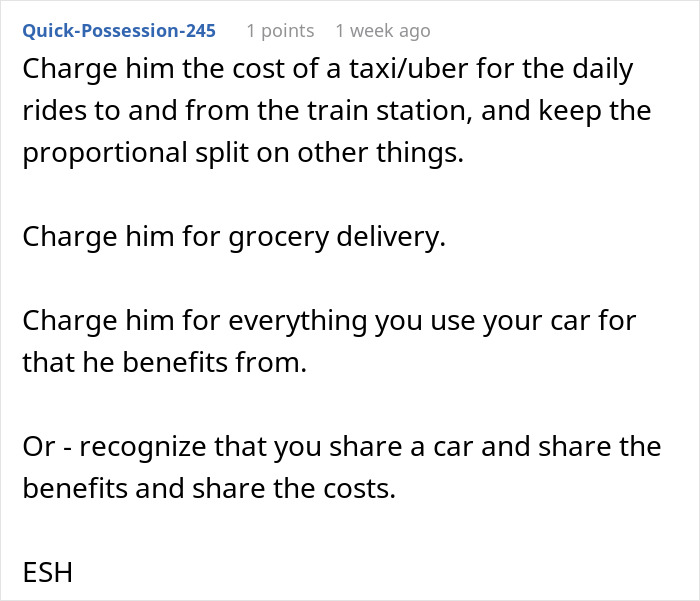

She says that sharing costs proportionally can also be tricky.

Are they based on income, usage, or necessity?

Does tracking these details create clarity or resentment?

Check out the results: