Share

Moneycan seriously complicate family relationships.

Especially when its spouses keeping financial secrets from each other.

Interestingly, its quite a common occurrence.

A recent study byBankratefound that 42% of Americans keep money secrets from their partner.

So many couples might have to deal with financial infidelity in one form or another.

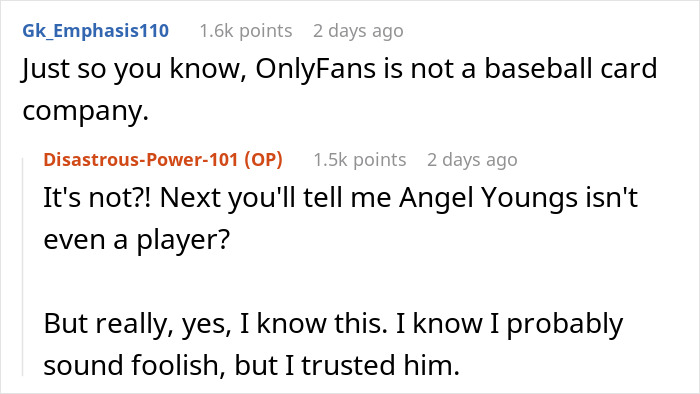

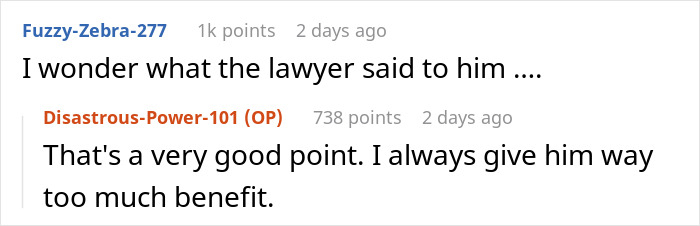

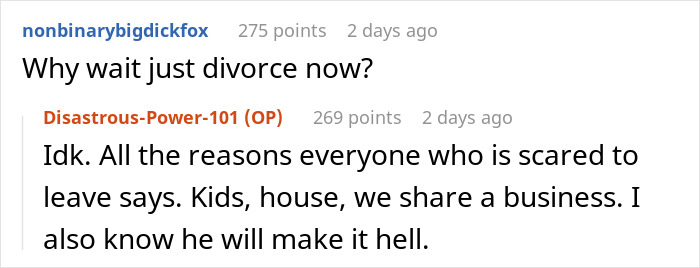

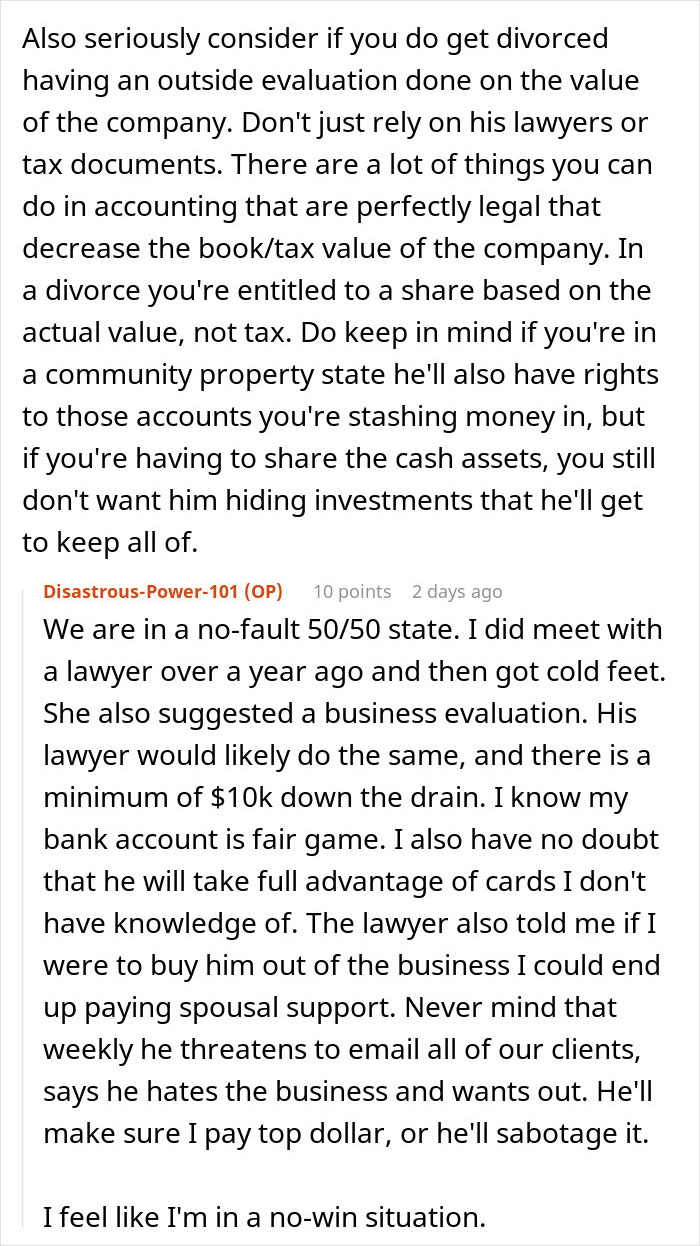

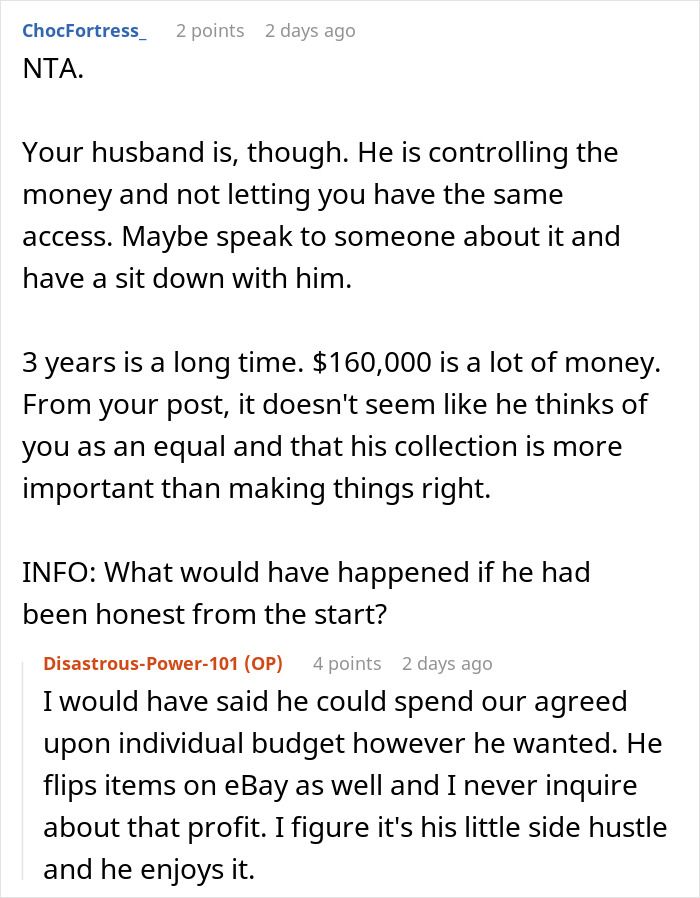

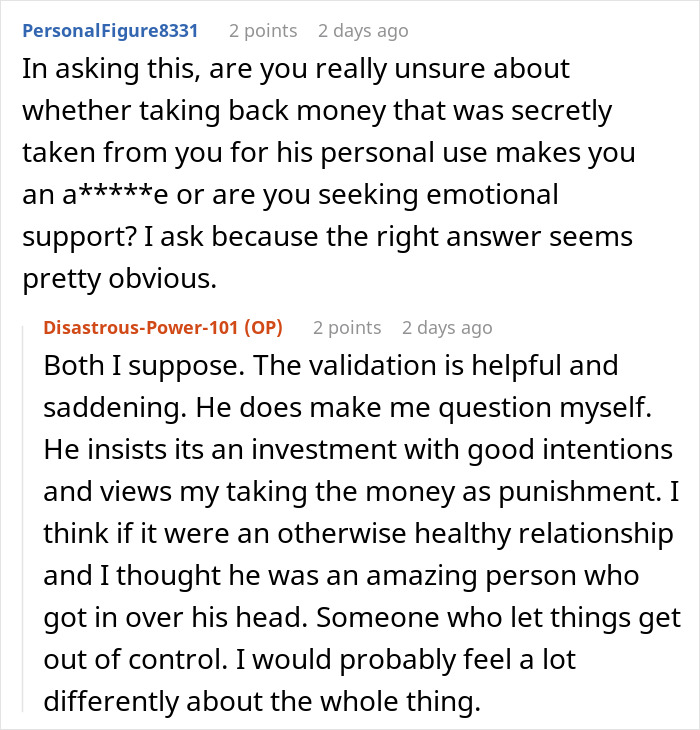

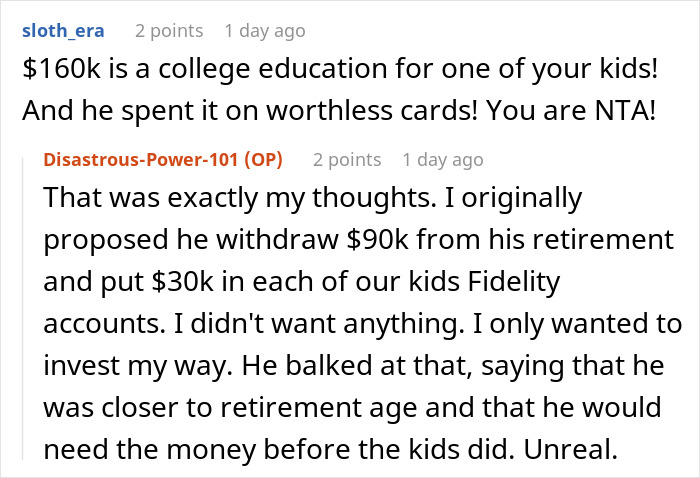

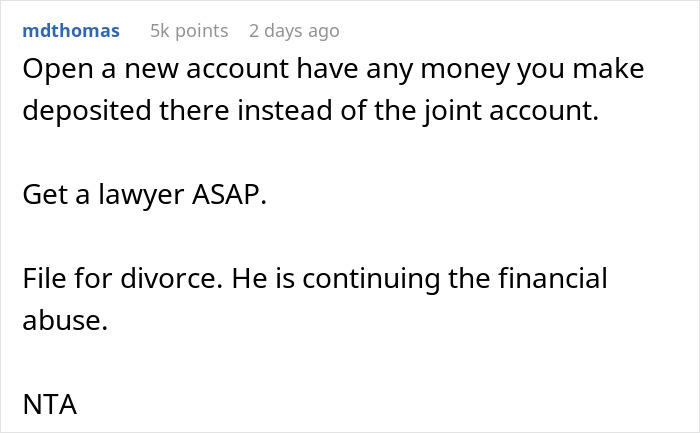

This particular husband was spending money from a joint account for something he didnt discuss with his wife.

However, when the husband found out, he thought it was unfair.

So the wife decided to check with the Internet:who was the jerkin this situation?

There isnt really one correct answer.

Some experts, likeDavid Ramsey, believe separate accounts are nonsense.

Others, likeSuze Orman, are believers in merging only a portion of the finances.

Orman recommends couples open twoshared accounts: one for shared expenses, and the other for savings.

And generally, she doesnt believe in taking couples finances to extremes.

According to her, partners should have joint accounts, but they also should have separate checking accounts.

Couples, married or not, may use it to cover shared expenses.

That includes utilities, food, rent, and common savings goals, like a vacation.

Emma Edwards, founder ofThe Broke Generation, has defended her decision not to combine finances with her partner.

She also believes that having a joint account is a tad outdated.

Nowadays, the world is set up for women and men to manage theirmoneythemselves.

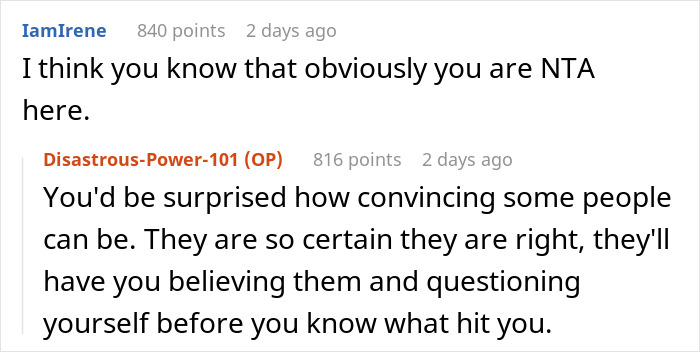

In the end, it all seems to come back to trust.

The researcher believes its all about bringing the two people together.

Theres also more transparency in therelationship, so the couple may trust each other more.

When they have a shared account, partners work towards shared goals.

It all becomes about our money and not just my money.

Garbinsky says that this logic for people triggers higher-order beliefs about their relationship.

Olsonsaidthat couples with separate accounts viewed their financial decisions in transactional terms.

Its I help you because youre going to help me later.

Theyre prepaying for later favors, and thats tit-for-tat, which we see a bit more with separate accounts.

But whether or not partners reported being happier, trust was still a major factor.

Combining your finances seems to be one way to force you to do that.

Image credits:Mikhail Nilov (not the actual image)

Thanks!

Check out the results: