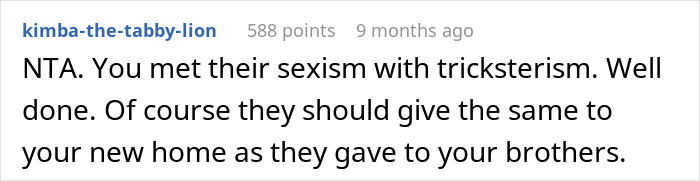

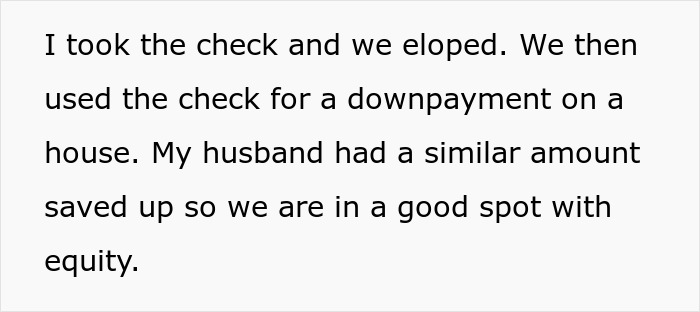

But there are others who prefer a more practical approach, investing the funds into their future instead.

Such was the case for one woman who recently shared her storyonline.

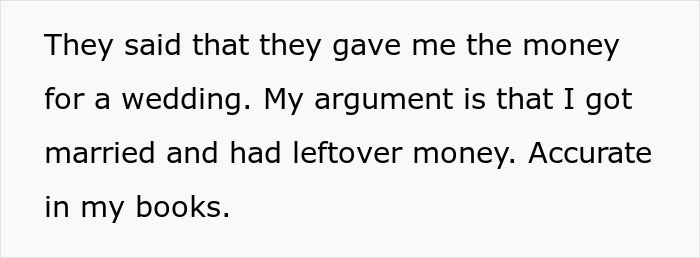

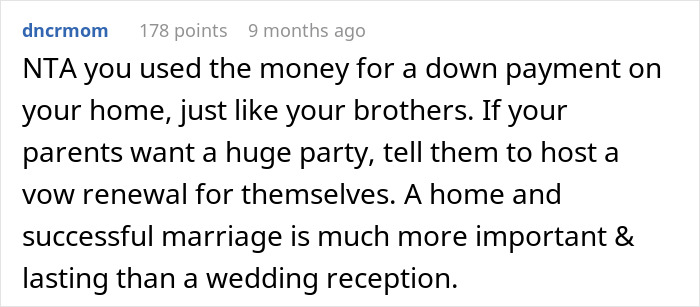

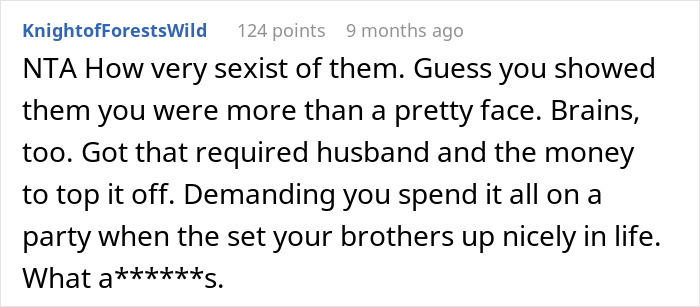

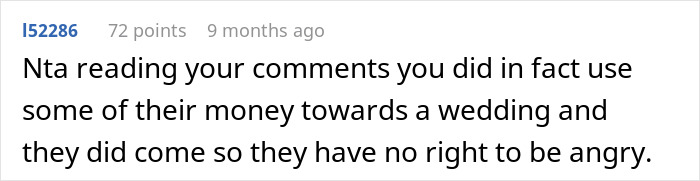

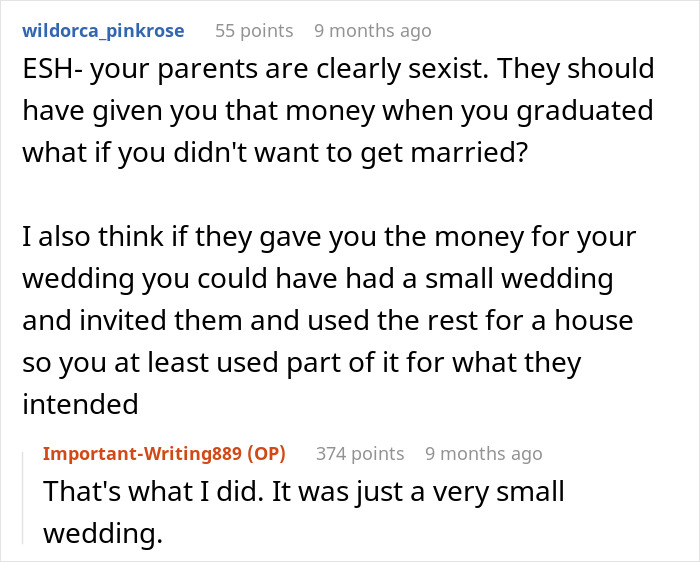

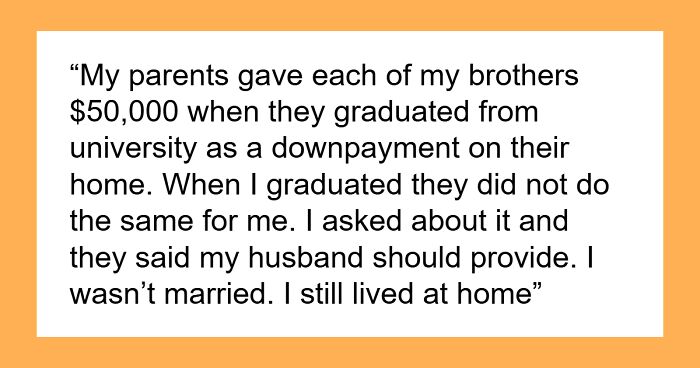

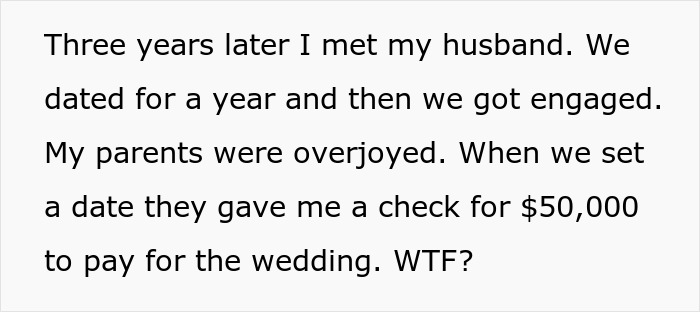

Her parents gave her $50,000, expecting she would host an elaborate wedding celebration.

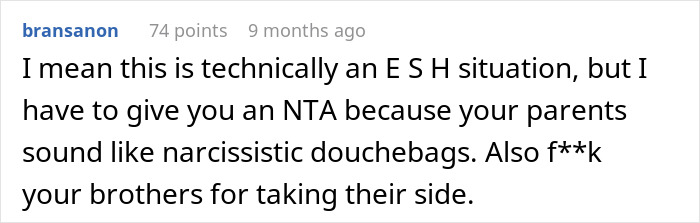

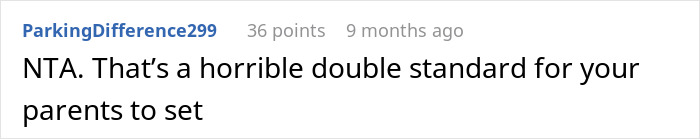

This decision led to a rift within her family, with her parents and even her siblings.

Keep reading to see how this family conflict unfolded.

Heres the thing: wedding costs can add up quickly, and the biggest expense is often thevenue.

Then theres the catering, music, and photography.

Capturing the day professionally can set couples back around $3,500 to $6,500.

Additional costs like attire, decor, and stationery can add up quickly, too.

Thewedding dress, suits, floral arrangements, and invites often take up a surprising chunk of the budget.

These elements, which might seem smaller, play a big role in creating the days atmosphere.

Weddings in the U.S. can range widely in cost, with an average of $33,000 in 2024.

Economic analyst Hannah Jones from Realtor.comreportedthat, nationwide, down payments hover around 14.4% of a homes price.

This average amount often makes couples consider: should we spend this on a wedding or a home?

Forbes Advisornotesthat down payments are slightly lower year-over-year as home prices have dropped since their 2022 peak.

For some, a grand, memorable wedding feels like a dream come true.

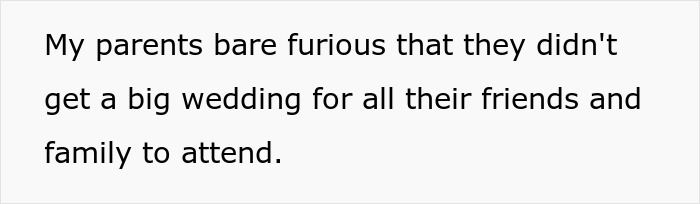

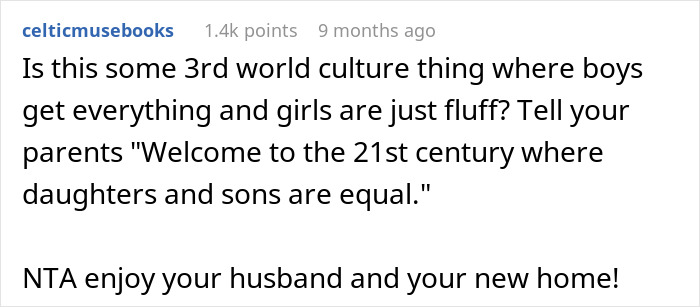

Her parents, however, had expected her to host a big wedding for family and friends.

The unexpected use of the funds led to family tensions, leaving both sides feeling unheard.

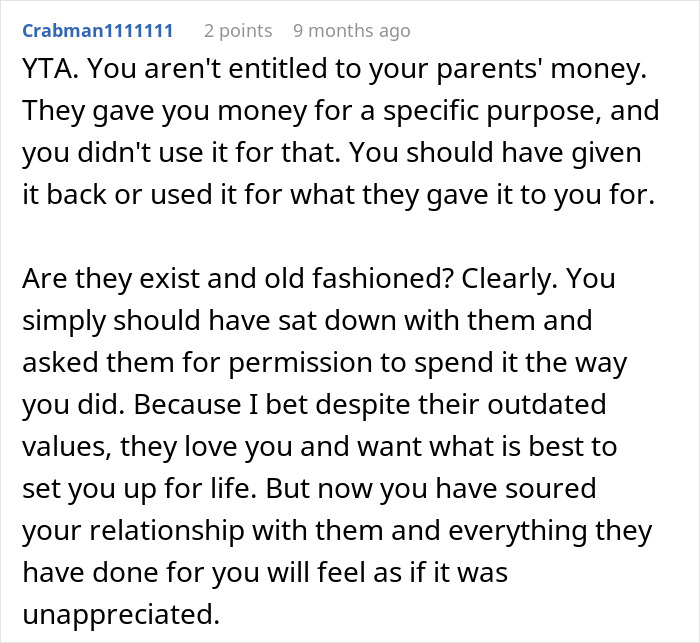

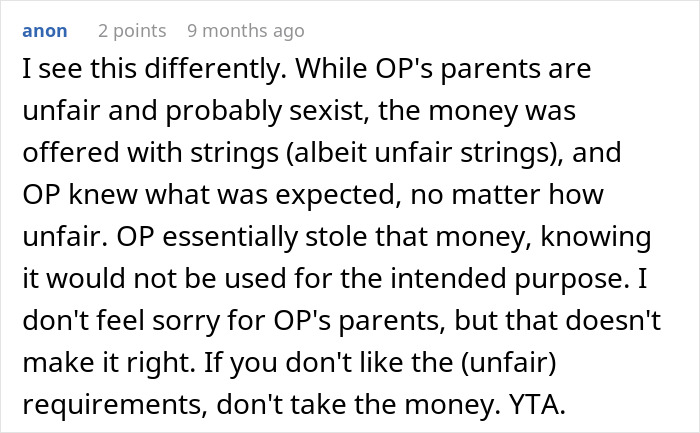

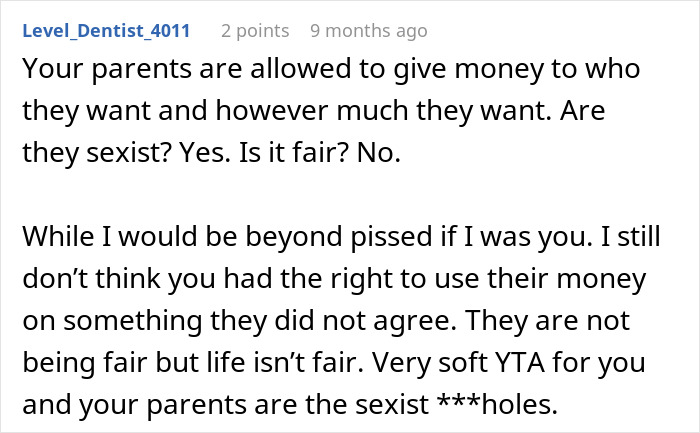

Check out the results: