Share

Parentingis no walk in the park.

It takes love, time, effort,patienceand, of course, lots and lots of money.

A recent studyputsthe average cost of raising a child from birth to age 18 at close to $240,000.

One single momsharedhow shes made many sacrifices over the years to save for her daughters college fund.

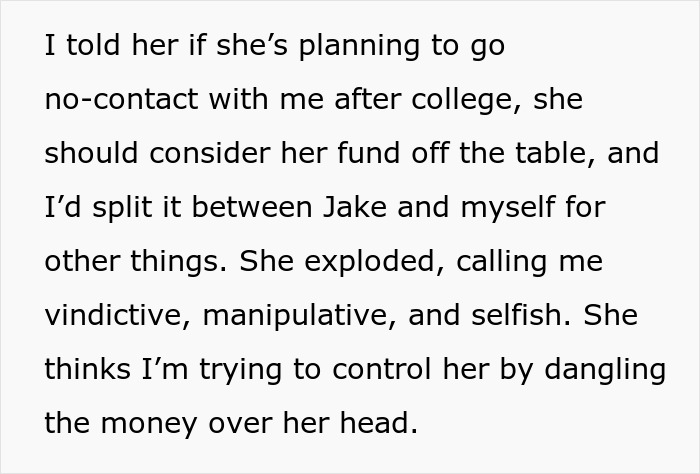

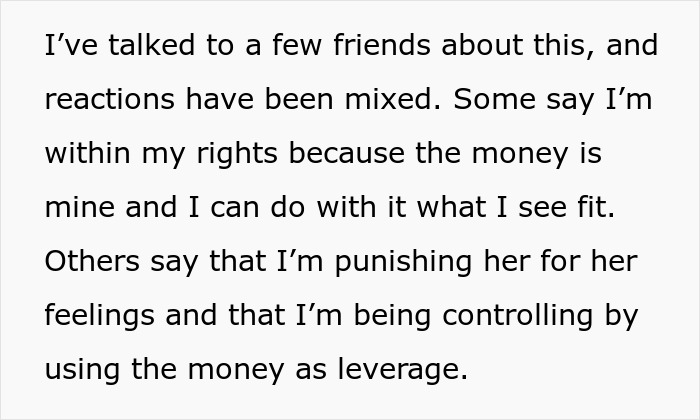

Only for her daughter to threaten to cut contact contact with her once she starts studying.

The mother is now considering keeping all the money, and spending it on herself and her son.

And over 43 million people have student loans to pay off.

Recent datashowsthat the average public university student borrows $32,362 to attain a bachelors degree.

Its a lot of money to pay back once, and if, you start working.

Given those figures, it should come as no surprise that higher education is expensive.

But if youre considering a prestigious university like Princeton or Harvard, youll be charged around $60,000 annually.

And thats just for fees.

The personal finance company looked at factors like student selectivity, cost & financing and career outcomes.

In terms of colleges, the top spot went to Swarthmore.

Hamilton College came in second, followed by Amherst, Wellesley, and Harvey Mudd College.

But that doesnt mean you should discredit colleges.

Bill Coplin is aProfessor of Policy Studies at Syracuse University.

He believes the main advantage ofIvy Leagueor name-brand schools is you get to web link withrich studentsand their parents.

And says the skill development is no better or maybe worse than other higher learning institutions.

This may be a mundane skill but others like using Excel may not be there either, said Coplin.

But if Ellas heart is set on a prestigious place of study, all is not lost.

Most Ivy League schools provide generous financial aid packages to low-income students.

Many students do not pay the sticker price, revealed Robinson.

Ella could look into things like federal financial aid, scholarships, grants or student loans.